THE WORD OF CEO

Julián Colombo worked almost 20 years for Banco Santander. Economist and with an upward career in the company of Spanish origin, he focused on enhancing its customer relationship management (CRM) software, an application that with the rampant step of the digitalization of transactional processes acquired increasing preponderance.

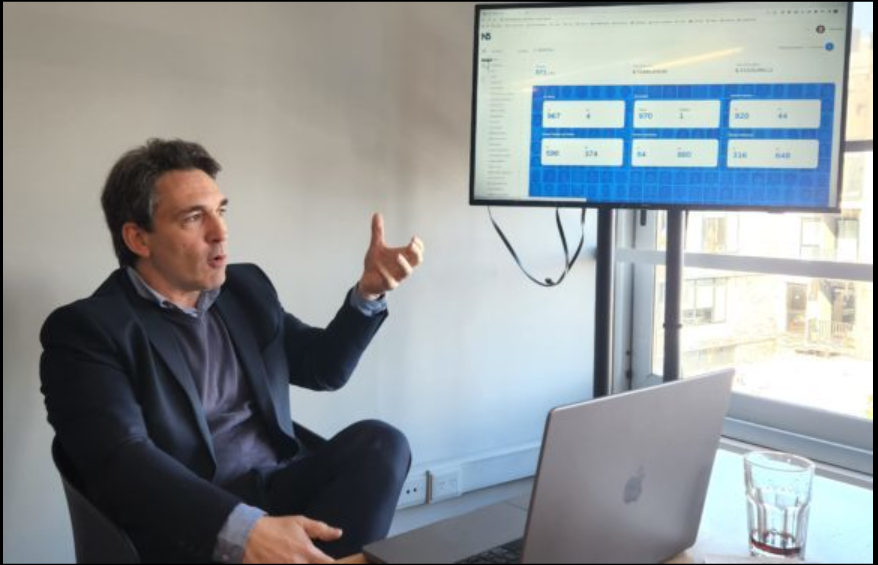

“I had the opportunity to learn a lot and at one point I came to the conclusion that the software for banks was designed for another industry, that it never worked well,” Colombo, who is located in São Paulo, where one of the offices of N5 Now, the startup he founded with another colleague while living in the United States and with which he optimizes the systems of the main ones. banks and fintech, a highly competitive sector within the framework of the digital transformation marked by the pandemic.

“I had the opportunity to learn a lot and at one point I came to the conclusion that the software for banks was designed for another industry, that it never worked well,” Colombo, who is located in São Paulo, where one of the offices of N5 Now, the startup he founded with another colleague while living in the United States and with which he optimizes the systems of the main ones. banks and fintech, a highly competitive sector within the framework of the digital transformation marked by the pandemic.

“The company was born and grew very fast only leveraged by customers. There were no investment groups, we showed the customer the product we had to offer. Today we have 200 employees in the region and about 50 customers from all over the world.”

¿Cuál es el principal componente que se encargan de resolver en la dinámica funcional de un banco o fintech?

Surely it happened to you, you called a bank to solve a procedure that you could not solve in your application and you found that the callcenter employee asks you for data that he should have in his system or does not know the procedure to assist you. Always your conversation facing the bank makes sense and the opposite should not happen on the other side. We want a bank to be able to serve a customer with perfect coherence and fluidity between its operating units to better respond to user demand.

There seems to be a struggle between banks and fintech in the face of digital modernization. What is the main deficit of each one and how do you seek to help them?

If you ask a bank what it wants to be, it will tell you that a fintech. To a fintech, a bank. Banks want to stay with their profitability strategy but evolve faster, while fintechs need to monetize operations to earn more. These have a high level of satisfaction but few people use them as their main bank, offer good accounts but earn little. The world is going to go towards a convergence in which banks are going to modernize a lot and fintechs are going to have to rationalize.

What changes did an event as significant as the pandemic bring in both sectors?

Definitely. Before, the size of a bank was functional to the number of branches they had: to compete with Bank of America you needed to open 8000 branches. In 2005 this began to change with transactional digitalization, although there were still operations that tended to be human. The pandemic limited that presence and the banks reacted by attending by Zoom or Teams, realizing that face-to-face is not necessary but the human.

It is that in short, humans do not consider financial relationships a purely transactional event but an event that has emotional and advisory components. While it is true that you can feel like making a trade without talking to anyone and touching a button, if you have to invest 400 thousand dollars you want an advisor you trust and with support in case you make a mistake.

So how could both problems converge in the face of the cleavage of solving the face-to-face and the digital?

It would seem that the sweet spot is to be very fluid digitally and very ubiquitous, that is, to be in the place and in the way that I want before relevant decisions. It is to structure the relationship with customers based on the customer’s need and not on your convenience at the cost level. A fintech or bank loses any kind of reference about its customer when it says it is going to attend by chatbot because it can assist two thousand people at the same time and saves a lot of money. All companies that are paradigmatic in their approach, whether digital or all human, are going to stick it.

N5 Now works for banks in the region, the United States and Europe. Do your Argentine customers differentiate themselves with specific problems?

There are very clear components, in Argentina the focus on issues related to transactional is disproportionate because it is a market full of frictions. Taxes and contributions vary. A German does not spend a second of his life on knowing how a tax varies. Even the client from Argentina is already different from the rest of Latin America because of the complexity of managing their daily money.

I imagine that this friction process makes it more complex to think about it for the Argentine user.

Completely. Countries such as Argentina or Venezuela have a very high level of rule modification. We built the scheme of a digital bank that operates in seven countries in Latin America. While argentina’s had to change it four times, while the other countries’ had none. You have a natural predisposition to regulation.

What do you think of this particular feature of Argentina and its aversion to change?

I’m very critical about that. Frequent rule changes are distractions. It takes sensible decisions and giving those decisions time. Constantly changing means net losses in an economy, I am much more favorable rules more stable over time.

Does the company have employees from all over the region, the Argentine worker is distinguished by some particularity?

There are recognizable patterns in every country. The archetype of the Argentine is someone intellectually curious, with self-confidence, something more verbal from the expressive and much more informal than the average of the region both in the levels of entry and in leadership. The Argentine is as people imagine him: creative and with a good education… although decreasing in time.

So don’t you advocate the idea that was installed about the Argentine employee being the best in the region for the technology sector?

If you are 45 years old maybe that is statistically supported, if you are 20 not. Before geographically all particularly highlighted the Argentine human capital. Now the regional level has been paired a lot.

How do you see the development of startups in Argentina despite the economic crisis?

Argentina will continue to generate unicorns and a lot of value. Talent is going to continue to exist, ideas are going to continue to be good. When you see a Mercado Libre, a Ualá, an Auth0, or anyone who creates value in Argentina I risk saying that he is not thinking of Argentina as his final destination, he is taking advantage to create talent, try one thing and expand to the world. We started almost the other way around.

Did you imagine your company being named by Microsoft for two consecutive years? How do you see the development of N5 for the next five years?

I didn’t imagine it. I am absolutely convinced that our product is unique and that the company we have has a culture and a spectacular customer work style. On the other hand, the hardest part for the company has already passed, before we had to go knocking on doors and today we can be selective of projects more convergent to our strategy. I am very optimistic about our future.

Publisher: JULIÁN ALVEZ