Did you know that about half of Latin Americans do not have access to a bank account? Even with the advances in technology of the last decade, a huge portion of the population continues to find it difficult to get banked.

In a few moments you will discover why this happens, how it involves banks, and how this situation facilitates the penetration of financial technologies in the sector.

Banking Rigidity Accelerates the Emergence of Fintech

Today, banks that are governed by traditional rules are seen as not very inclusive. Rigid bureaucracy, waiting times, and high operating costs make banks see a more cumbersome and inaccessible option for the public.

To see how expensive the services of traditional banks are in Latin America, just take a look at the following graph that measures interest rates in the region in contrast to the rest of the world.

It is these complications that mean that around half the population does not have a bank account, and only 15% keep their savings in financial institutions.

Mobile Telephony Is A Powerful Ally

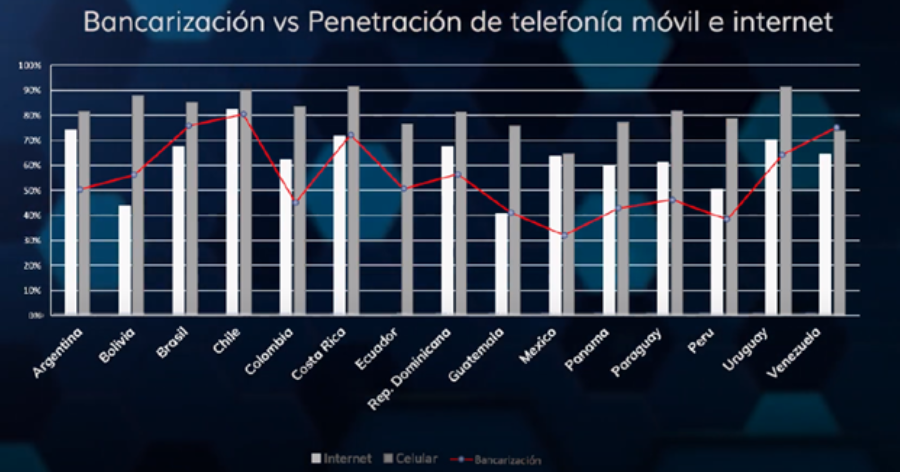

According to data from the World Bank, 90% of Latin Americans are under 65 years of age. It is a young population, more familiar with technology than with the processes of traditional institutions, as the following graph indicates:

As you can see, in most countries mobile penetration (gray line) exceeds the bankarization rate (white line). People simply get along better with these technologies than they do with banks. Perhaps the population does not understand the complexity of fees and interests, but they know how to handle their cell phone perfectly.

It is this situation that makes it so easy for fintech companies to penetrate the market. Why spend money, hours in line, and days of bureaucracy, when just downloading an APP can solve everything?

This is exactly what brings us to the next point.

Fintech Targets An Unbanked Public

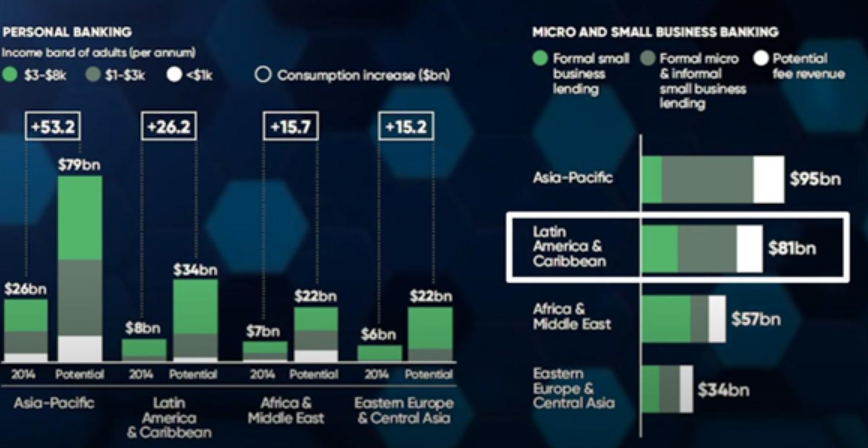

Such complications with traditional banks and the convenience of new technologies have created an ideal situation for financial technologies that are coming to cover a new segment of the population. Now these fintechs are stomping on a trillion dollar industry, advocating for an audience of individuals and SMEs with low banking. In fact, as seen in the graph, it is estimated that the unbanked and underbanked sector in Latin America represented in 2017 a potential market of $ 34 billion a year for personal banking and of $ 81 billion for SMEs.

In other words,the technologies for the financial industry came to satisfy a huge need that had been neglected– that of more flexible and accessible financial relationships.

Without going any further, according to MercadoLibre, 35% of its borrowers would not have been able to access a formal loan. On the other hand, 20% of Nubank customers declared that the fintech’s credit card was the first they had in their lives.

It is for reasons like these that Open Banking today is more decisive than ever.

Fintech Complement Banks

At first it might seem that fintech companies are looking to rival banks, but there is nothing further from the truth. Everything indicates that these arrived to satisfy the needs of a fragment of the population that had been left behind, instead of trying to dethrone financial institutions.

Banks can actually use this as an opportunity and take advantage of fintech’s technological capacity to reach an unbanked public – just like their handling of customer data. In turn, fintech companies can benefit from the solidity and reputation of banks. This is one of those cases where clearly unity is strength.

Perhaps this is why, by 2017, two out of every three banks were working together with a fintech, and 70% planned to work with them in the coming years. Considering this panorama, it is not surprising that 55% of banks do not consider financial technology companies as a threat.

However, it is important to keep the context in mind. For example, in Brazil, where traditional banking has been characterized by being especially rigid and handling very high interest rates, it seems that fintech companies have already begun to gain ground from banks. Just take a look at this ranking of the best banks when it comes to satisfying their customers.

.

As you can see, the top of the ranking is crowned by five different financial services technology companies, with a traditional bank only in sixth place.

Fintech companies are growing fast in the region with Brazil at the helm

Where there is a need to satisfy there is a market. Fintechs came as a response to the need for more flexible finance, and the results speak for themselves. Even despite having arrived a short time ago, its expansion is accelerated, growing by 39% each year.

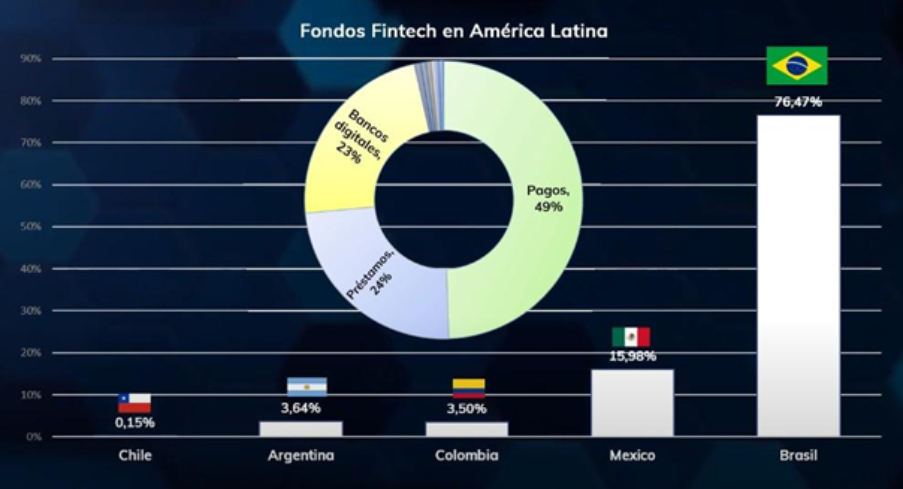

Just take a look at the more than 1,300 financial services companies already operating in Latin America, of which 49% focus on payments and loans – a clear answer to the problem of rigid and expensive banks.

But the idea of ??payments, loans and digital banks attracts not only the public, but also investors. 96% of total investments are focused on these areas, with Brazil leading by far as the most desirable place to bet, as you can see in the following graph:

This only means one thing: the fintech industry will only continue to grow in the years to come. These technologies are simply too attractive to the public – they are simple, accessible, and inexpensive – and that is exactly what people want.

It is a fact that when a business takes advantage of the environment and solves real problems, it has part of the guaranteed success.

Editorial: Marcelo Frette