Exploring trends, news, innovations and technological tools is an essential practice in all business sectors. However, in the dynamic financial market, where competition intensifies with the growth of digital banks and fintech, this attention becomes crucial. Banking technology emerges as a key element to differentiate and highlight companies in this highly contested scenario.

These solutions not only provide optimization and automation of operations, resulting in gains in agility, efficiency, productivity and savings, but also elevate the customer experience. This is reflected in simplified access to the bank, the offer of improved services and the availability of various payment methods.

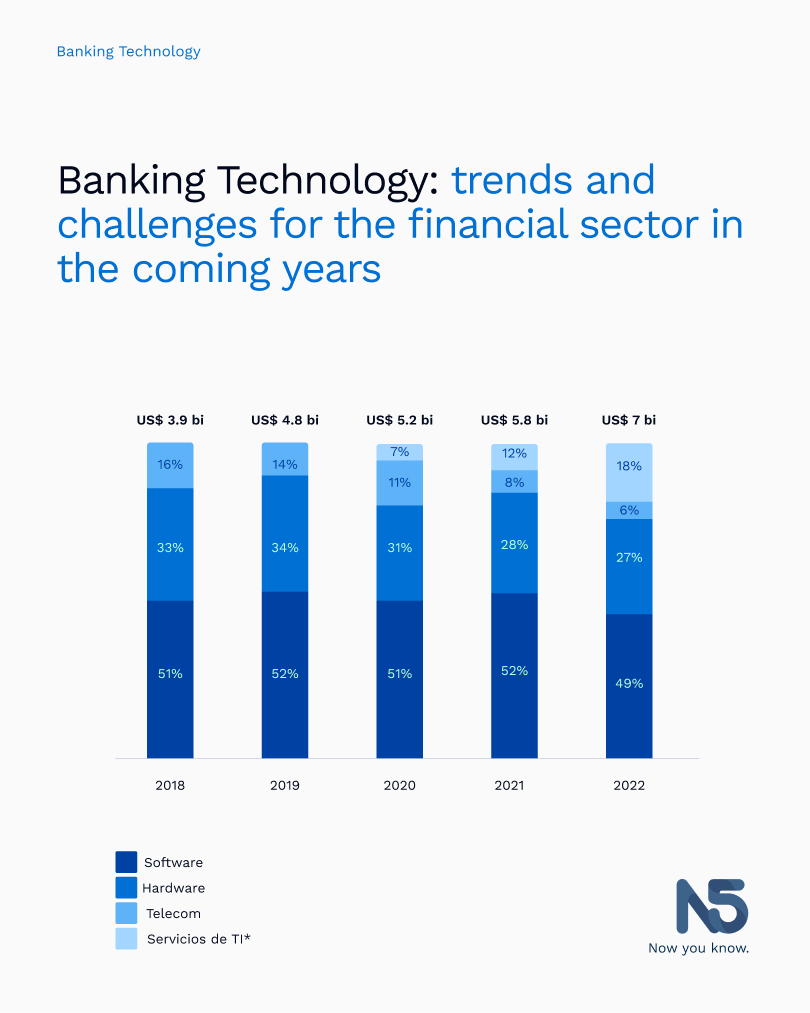

The magnitude of this impact is evident in the numbers: in 2022, banks invested significant USD 7 billion in technology, registering a growth of 18% compared to 2021, as noted by Febraban in collaboration with Deloitte. Projections for 2023 are even more promising, with a significant increase of 29% expected, surpassing the USD 9.4 billion mark.

Faced with this scenario of constant evolution, the question arises: how to make successful investments capable of generating tangible results for your institution? The answer lies in the need for companies to keep an eye on major trends and understand the challenges intrinsic to banking technology. Below, we share what the current financial market scenario has brought with it:

- Growth of fintech and digital banks.

- Consolidation of digital payment methods.

- Increased banking: In 2021 alone, 73% of adults in Latin America opened bank accounts and 90% carried out digital transactions.

- Expansion of Open Finance.

- Use of artificial intelligence.

- Consumer demand for more agile processes and better experiences throughout the banking day.

- Less customer loyalty with financial institutions, since it is easier and faster to change banks. A study by Take Blip showed that 7 out of 10 customers changed banks in search of better service.

Digital transformation requires specialized technological solutions for the financial sector, capable of breaking down the natural barriers that prevent innovation in these organizations. Trust N5 to help you once and for all prepare for the future, which has already begun.

We are the only company in the world that offers an exclusive systematic platform for the financial sector. It is a state-of-the-art product, prepared for Open Finance, which natively integrates all the software necessary for this industry (CRM, BPM, Incentives and Omnichannel), allowing an agile and efficient approach. With technology based on business intelligence and our implementation experience, it allows us to create an efficient, effective and powerful connection with customers, adding greater value and accelerating business growth.

Schedule an appointment with us now to learn more: https://n5now.com/schedule-demo/