The operation of large banks involves processes that are not found in companies focused on a digital world.

An opinion article written by our CEO, Julian Colombo, where he delves into the concept of “Technological Entropy” and how this impacts financial organizations, has been published exclusively in the prestigious Mexican media Expansión.

This text not only clarifies a complex concept but also offers valuable insights into how businesses and individuals can navigate an ever-changing technological environment. We invite you to read the content and join us as we explore transformative ideas and revolutionize the paths for a simpler, more agile financial sector.

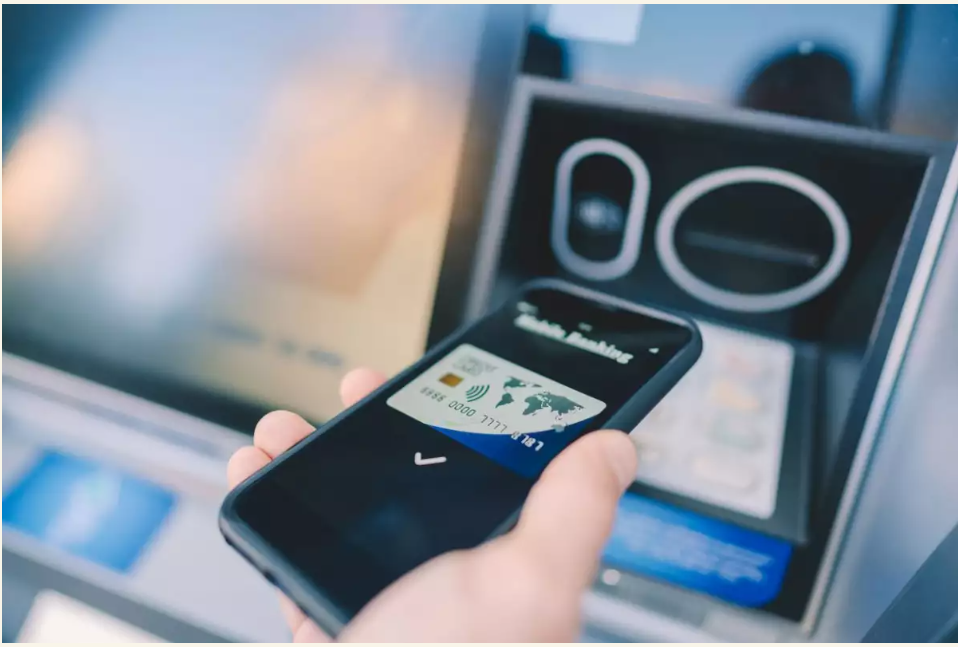

While a bank looks for reputable providers that provide generic solutions, fintechs have the agility to build their own software or partner with highly specialized providers, says Julián Colombo. (iStock)

In the last decade, the arrival of fintechs generated an irruption. Traditional banks allocated resources to beat new competitors in the “game”, not knowing that their obstacles would be in their own systems, and that the technologies they see as enemies could be their solution.

The operation of large banks involves processes that are not in place in companies focused on a digital world. For example, they must take care of their physical branches, the apps for their customers, the ATMs, the call center for their various products, or even their sales forces to consolidate their portfolio in each of the segments they offer.

Inside, the complexity of managing its ecosystem is what is called technological entropy, which is nothing more than a disorganization of its systems, with thousands of active software (up to 70,000), which do not communicate properly; They work intermittently, have stability problems or, in the breakneck gear, become obsolete.

In addition, let’s think about the cases in which one bank acquires another, so that it not only swells a portfolio of customers or services, but also processes and systems, since it absorbs previously signed software contracts, which make the operation terrifying. It’s like having to change the wing of an airplane while it’s in flight and with the customers on board.

Who could innovate and compete in the face of the new options of fintechs, when the urgent thing is to correct the daily operation? More than a question, it seems that we are facing the answer to why traditional banking does not find a way to compete with more agile and technology-focused companies. It’s extraordinarily difficult to keep a legacy ecosystem operational while also implementing new processes.

I am not suggesting that the mismanagement of technological structures within traditional banking could trigger a global financial crisis; But they are undoubtedly the cause of enormous inefficiency, customer dissatisfaction, and losses estimated at hundreds of billions of dollars within companies.

What happens in large companies in any industry, not just banks, is that decision-makers build or acquire software tools tailored to something in particular. Over time, more and more technologies are deployed that are added to other systems and processes, until you have thousands of separate threads that make it difficult to communicate and exchange data between departments.

Segmented technology obstructs communication and creates a detrimental opportunity cost. Departments within an organization operate in isolation, each with its own specialized software and data repository. So when a customer interacts with multiple facets of the institution, the experience feels disjointed and inefficient.

Interestingly, technological entropy also includes an unwillingness to address this issue, for fear of making things worse, without taking into account that failure to innovate leads to higher maintenance costs and more vulnerability in security breaches, a sensitive issue in banking matters.

To the question of whether fintechs are a threat or an antidote, from my experience the answer is that the latter provide cross-functional collaboration. With their agile and flexible teams, plus cutting-edge tech stacks, startups have the freedom to experiment and deploy faster than traditional companies.

Editor: Expansión, MX

Editor’s note: Julián Colombo is CEO and Founder of N5. Follow hin on LinkedIn . The opinions published in this column correspond exclusively to the author.