5 Keys to Understand the Importance of Open Insurance in Latin America

Open Insurance is a new way of doing business that allows insurers to skyrocket their sales and increase efficiency. It is about opening data access to other organizations and sharing data across different industries.

Much has been said in these times about Open Banking, which is experiencing accelerated growth in Latin America. But what about the insurance industry? How is the landscape changing with digital acceleration? Is it an opportunity or a threat?

Today in N5 Insights we present you 5 keys to understand why Open Insurance is going to be going strong in the coming years and what its biggest challenges are.

Open Insurance Becomes Indispensable

The Open Banking boom started a domino effect that affected the world of finance entirely. One of the sectors most affected and perhaps least prepared is the insurance industry – one of the most technologically backward.

The good news for this industry is that you can take the Open Banking transformation as a reference, so you don’t need to grope your way.

For example, insurance company owners could take a look at what happened to the banks. When the digital transformation began, those who most refused to accept it were the ones who ended up making way for fintech. Those who adapted, instead, were able to compete thanks to the conveniences and benefits that digital media offers.

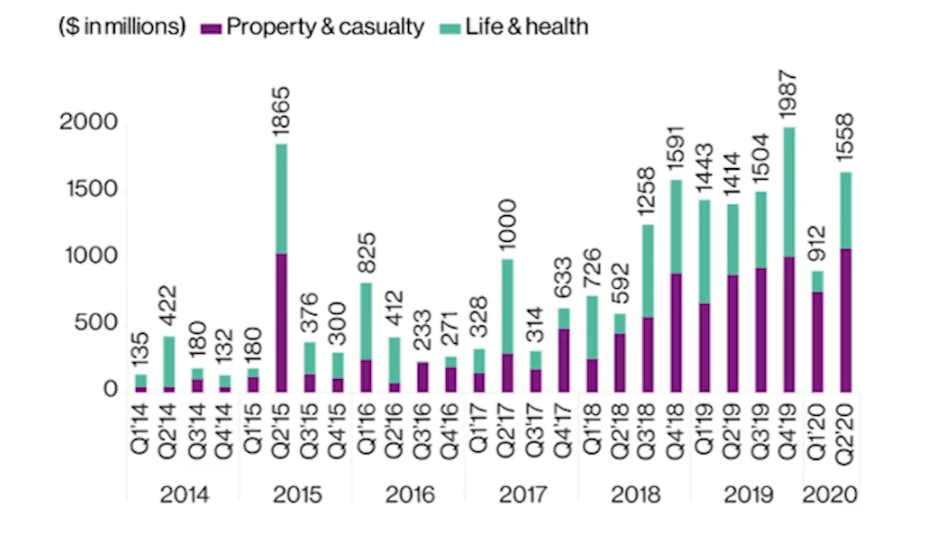

But is such a transformation really coming? Well, just take a look at the following chart showing Insurtech investments – new insurance technologies – in recent years.

As you can see, the millions allocated to this industry do not stop increasing over the years. The most interesting? That this graph ends in 2020, the year that digital acceleration began. If what happened in recent years was accelerated growth, what happens in the years to come may be completely on another level.

Open Insurance Is A Great Opportunity For The Insurance Industry

Times of change are often times of opportunity. And when it comes to the insurance industry, the opportunity has never been greater.

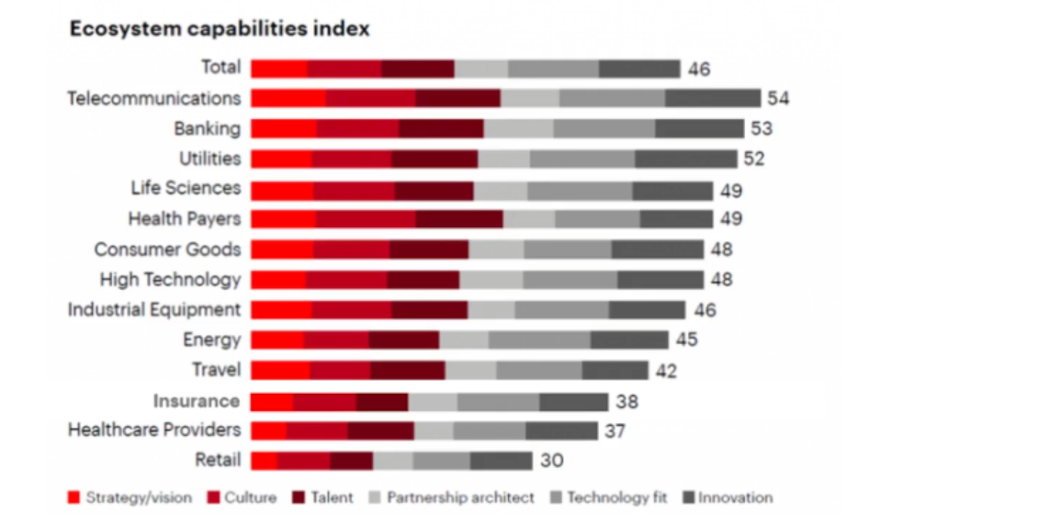

We are talking about a highly conservative industry with a low technological advance in general. Without going any further, only 5% of insurers have what it takes to participate in digital ecosystems. Just look at the chart below that shows how far behind the insurance industry in technology and innovation.

While competitors such as banks are high, the insurance industry is almost at the bottom.

What does this mean? That those insurers that know how to read the situation and update themselves first have a huge opportunity to face the competition.

In addition to that, there are the many advantages of joining the digital ecosystem:

- Lower operating costs and higher efficiency

- More products to offer, with a more diversified offer

- Being able to reach a much greater number of people

- Positioning yourself beyond the traditional market

- Happier (and loyal) customers

An example of early implementation benefits occurred in Europe. Those who implemented Open Banking on time saw a 55% increase in revenue.

The first mover’s advantage is as real here as anywhere.

The First To Implement Open Insurance Will Set The Rules Of The Game

Unlike with Open Banking, the Open Insurance process is still in an early stage.

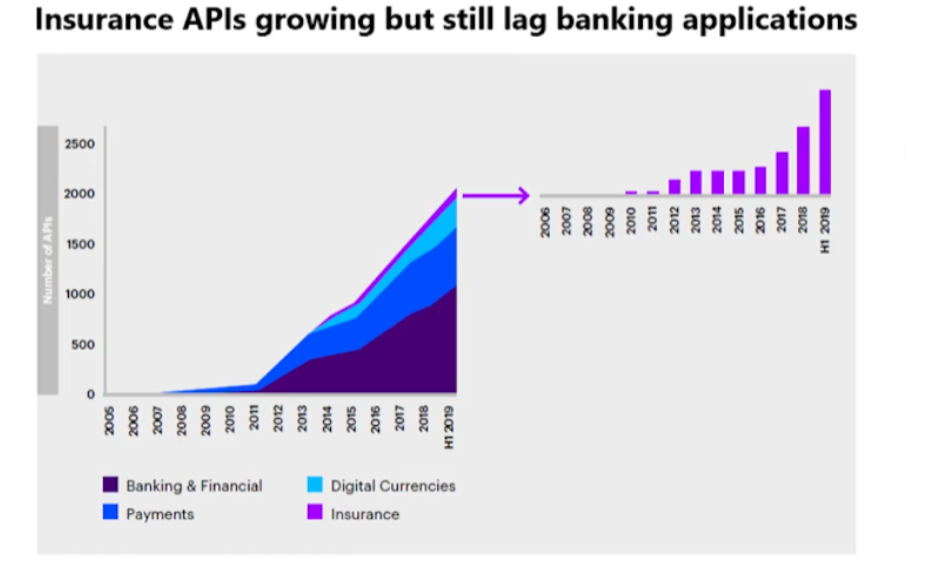

Just take a look at the following chart:

As you can see, the number of APIs available to insurers is only a small fraction of what is offered in the banking industry. It’s just a fine purple line, for now. But as you saw above, everything predicts that this line will grow more and more in the coming years.

If this were a match, we are at the opening ceremony. Now more than ever those insurers that know how to incorporate new technologies are the ones that are going to position themselves higher.

The best part? That as the regulations are just beginning to be negotiated, those same well-positioned insurers are the ones that are going to shape the rules of the game.

Brazil Leads The Head In Open Insurance

Brazil is the most advanced country in Latin America when it comes to implementing new finance technologies, and with Open Insurance it is not far behind.

In Brazil, many points regarding Open Insurance are already regulated: from the scope of its services to the rules when sharing data.

This process is divided into three stages, with a calendar that runs from December 2021 to June 2023.

In the first phase, insurance companies are expected to open access to information on their products. This includes prices, offers, conditions, etc.

In the second phase they will focus on the exchange of information between users.

Finally, in the third phase, this process will be consolidated. Companies will now be free to offer their products and services in digital ecosystems.

Different Regulations For Different Scenarios

With Open Banking, we are already talking about sharing user data, which is delicate. However, when it comes to Open Insurance the issue becomes even more complex.

It is one thing to share a financial statement, the other is to reveal information such as the health status, sexuality, or even the political preferences of a client. That is why confidentiality takes on a much stronger weight with Open Insurance and will be one of the strong points in the regulations.

On the other hand, in insurance you work with a large number of business lines and products that probably require different perspectives. The regulation required for cultural insurance is not the same as for more delicate issues such as health insurance or pensions.

Conclusions

As we saw in this edition of N5 Insights, Open Insurance is a trend that is preparing to stomp in the coming years. We are in an exciting stage where regulations are just beginning and what happens now will decide the landscape for a long time to come.

These are the main points to remember:

- Open Insurance is here to stay

- Insurers that adapt to new technologies will not only be above the competition but will also gain many benefits

- The first to implement Open Insurance will be in a good position to shape the upcoming regulations

- Brazil is betting heavily on new insurance technologies

- The large number of products implies that there will be different regulations depending on the niche

Publisher: Marcelo Frette