Current State of Open Banking in the World

Open Banking is a sector of the financial industry that has advanced by leaps and bounds in recent years throughout the world. Not only at a regulatory level, but also in the area of platform and API development.

In addition, the important role played by pioneers such as the United Kingdom, the European Union and Australia has accelerated its adoption at a global level.

Let’s take a look at the current state of Open Banking in the world.

Open Banking Regulations in the World

It is evident that the United Kingdom and the European Union are the most advanced players in the world in terms of Open Banking. However, since 2020 there has been a growing acceleration in this matter in all regions of the world.

So much so that by the end of 2021, more than 60 countries have regulations on certain aspects of Open Banking — approved or under discussion.

Just take a look at the chart below to get an idea of the impact Open Banking is having around the world.

Fuente: Platformable, Open banking Trend Report Q1 2022

Alt: Map of the evolution of the Open Banking regulatory framework in the world

Although it is not yet something established worldwide, many countries have already begun to discuss or apply Open Banking measures.

Many of these countries are actually working on expanding regulations that go far beyond just Open Banking. For example:

- The United Kingdom, through its Smart Data initiatives, and the European Union, with its Digital Financial Strategy, are making progress in expanding their regulations to allow the exchange of data within and between sectors.

- In Asia, several countries are working with regulatory frameworks focused on Open Finance. The most concrete cases are the Philippines and India.

- Australia is going one step further by working on cross-sector data sharing, which means going beyond the financial sector. New Zealand is working in this same direction.

- In Latin America, Brazil is the most outstanding case with its Open Insurance implementation plan. Colombia is also making progress in this area through the publication of a draft framework for Open Finance.

- In Africa, South Africa and Nigeria stand out for their work in introducing a framework focused on the implementation of Open Finance in their respective countries.

- In the United States and Canada, public consultations are being carried out with a focus on Open Finance.

The Number of Open Banking Users Grows

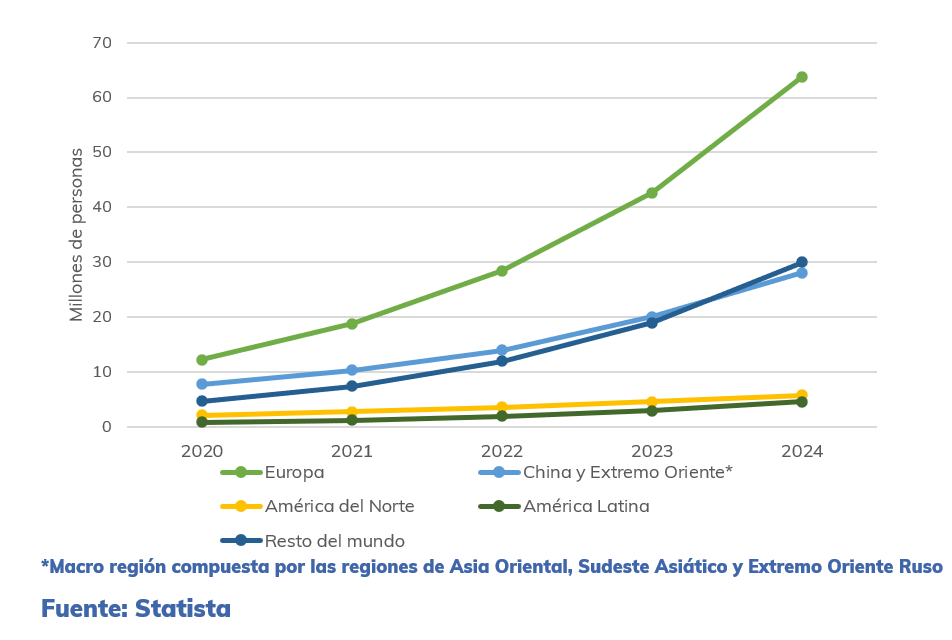

Open Banking is not just about regulations. Over the next few years, it is expected that there will be a significant increase in the number of users of open banking services worldwide.

Initially, the adoption of Open Banking moved by modest margins. In 2020, for example, only 25 million people used Open Banking services. Logically, most of these were in Europe.

However, its adoption has been increasing rapidly since then. Today, a 50% annual growth in the user rate is estimated until 2024.

Alt: Projection of Open Baking Users by Region

Latin America is the region with the highest growth projection. It is estimated that by 2024, the user rate will have increased by 463% compared to 2020.

Growth of APIs for Open Banking

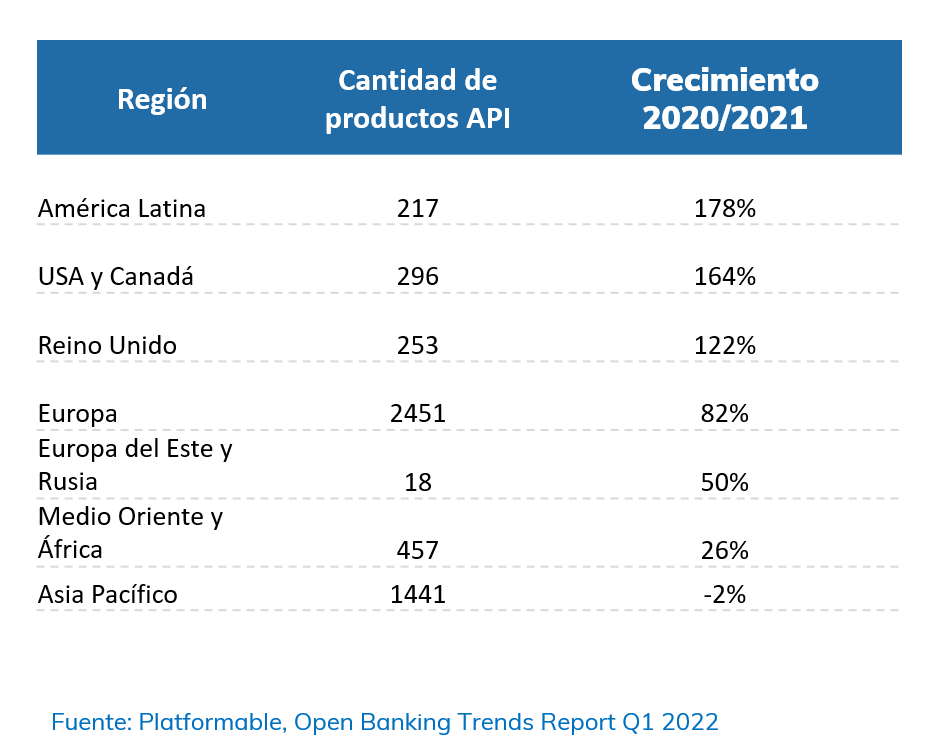

The growth in the amount of development dedicated to Open Banking platforms and APIs is not far behind. In all regions of the world, these have been developed, counting by the end of December 2021 with 1,537 API platforms and 5,133 API products worldwide.

In this regard, it should be noted that Europe continues to be the leading region both in terms of API platforms and the number of products developed. They currently have more than 1,153 developed platforms, which is 8 times more than Asia Pacific, the region that follows in this area with 184 platforms.

At the level of API products, Europe has 2,451, followed by Asia Pacific with 1,441 products developed until December 2021 and the Middle East and Africa, with 457 products.

The following graph shows the status of the development of platforms and APIs worldwide.

Source: Platformable, Open Banking Trends Report Q1 2022

Globally, in addition, there has been a 47% increase in the total number of API products available between 2020 and 2021.

It should be noted that Latin America and the United States are the regions that are experiencing the most important growth in the number of API products developed.

In the case of Latin America, this growth is also being driven by Brazil and Mexico, where Open banking is in full phase of implementation and expansion, according to the schedules set in both countries.

The apparent decrease of 2% observed in Asia-Pacific can be explained by the transition that banks in this region are undergoing from developing granular API products to generating integrated APIs with a greater number of functionalities.

Alt. Growth of APIs for Open Banking by region

Alt. Growth of APIs for Open Banking by region

Mandatory API Development

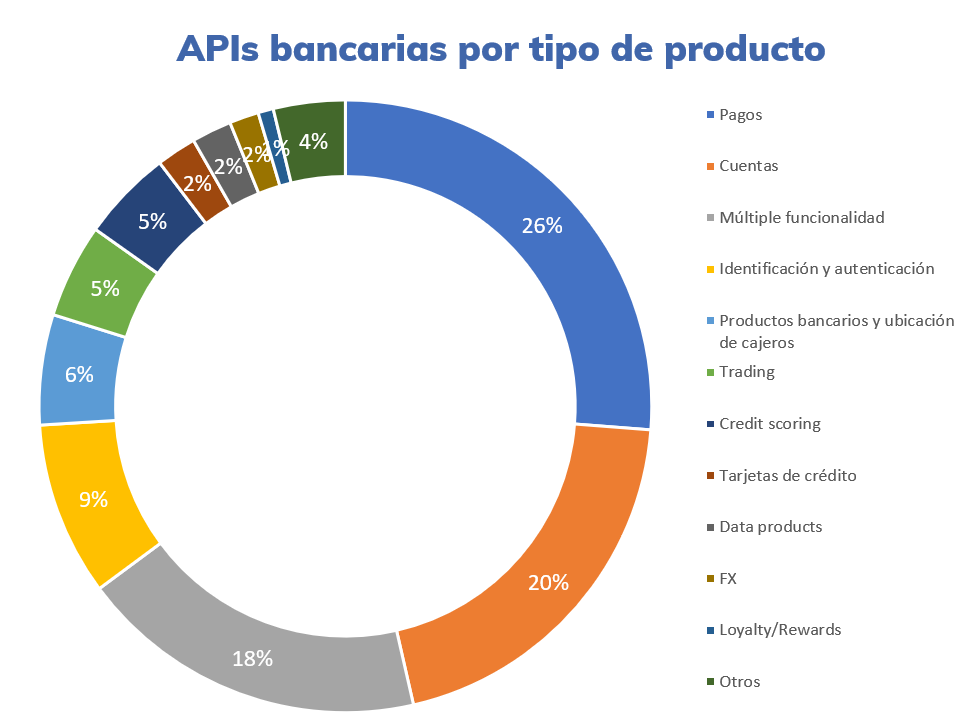

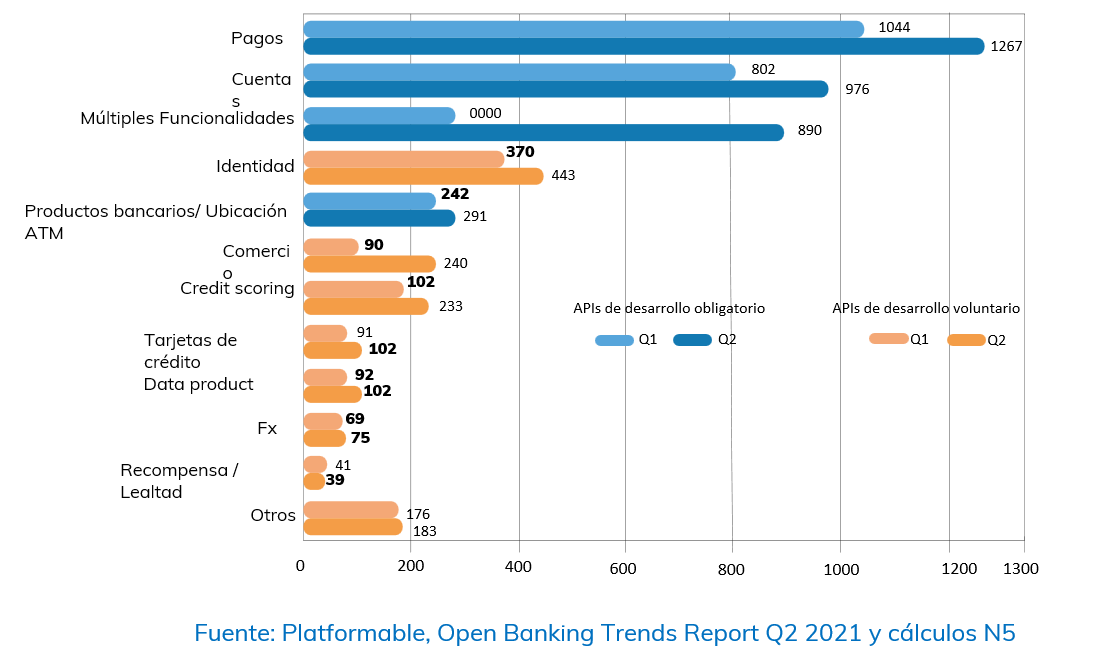

The mandatory development API products continue to be the most frequent in the total number of APIs developed to date.

Of the total of these, those related to accounts and payments represent a large majority, occupying about 50% of the total products generated. Clearly, this is related to meeting the requirements stipulated in the regulatory frameworks of places like the UK, Europe and Brazil.

Let’s take a look at what the rest of the developed APIs consist of:

Source: Platformable, Open banking Trend Report Q1 2022 y cálculos N5

However, despite the predominance of mandatory APIs, a trend towards the development of increasingly innovative products is being observed.

In recent years, the regions have been increasing the development of APIs linked to Credit Scoring, Identification and Authentication, and Trading services, which between the three already account for 20% of all products developed worldwide.

It is estimated that this trend will increase during 2022.

Trading APIs, for example, grew 150% between the first and second quarters of 2021 — which may be due in part to industry growth. Those of Identification and Authentication and those of Credit Scoring, increased 20% during the same period, highlighting the interest of banks in promoting the acquisition of new clients.

ALT: Banking APIs by product type, 2021 trends

Standardization of Open Banking Applications

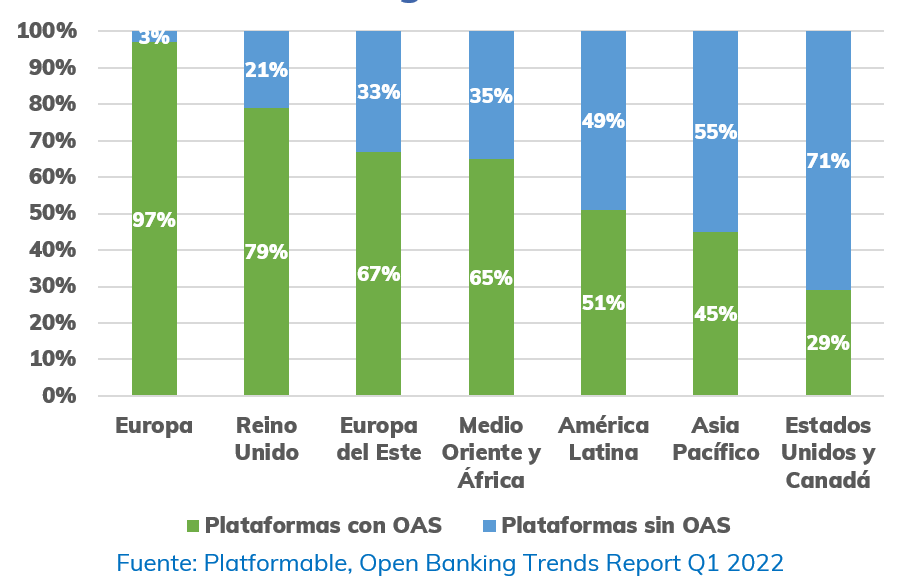

We can also find important advances in the standardization of applications. Currently, 84% of the banking platforms in the world are using the Open API Specification Standard (OAS)* to describe their APIs.

Why is this important? Well, because the use of standardized APIs contributes to the growth of Open banking. It helps simplify processes and communication between actors, speeding up implementation and making it easier for third parties to understand the services contained in these APIs.

Once again, the European Union is a leading actor in terms of standardization. By having almost 100% of its APIs with OAS. It is followed closely by the United Kingdom, with 79%.

The United States and Canada are the least advanced in this regard. Both lack regulations that help guide and organize the Open banking process.

Open Banking Security

Despite being one of the main objections to the implementation of Open Banking, security continues to be one of the main priorities for this sector.

The number of security incidents attributed to Open Banking is extremely low, especially when compared to other sectors.

For example, in the second quarter of 2021, only 6 security incidents related to banks and Fintech were registered, just 16% of the total reported in all industries. This low percentage has been a constant since 2020.

But why is Open Banking so safe?

One of the main factors in reducing incidents attributable to Open Banking is the use of robust authentication protocols and authorization processes. These assure companies that only agreed-upon information is being shared, and with the right API consumer.

Among the authorization protocols used in the world, the most popular and recommended is OAuth 2.0, which is recommended by key standards such as UK Open Banking, Berlin Group and STET.

In fact, 88% of banks currently claim to use this type of protocol for their authentication processes

Conclusions

As we have seen, Open Banking is in a state of increasing expansion both globally and regionally, with an extremely favorable outlook ahead.

Here are some of the main points to keep in mind:

- Open Banking regulations are growing worldwide, with several countries that have already begun to implement measures and others that are in the evaluation stage.

- The number of users is increasing, with an annual growth expectation of 50% until 2024.

- The growth of APIs and Open Banking platforms continues to increase, which increases the opportunities for the sector when it comes to providing services.

The regulations imply the development of mandatory APIs, but there has also been room for innovation. - The standardization of APIs plays a fundamental role when it comes to streamlining processes.

- The Fintech sector remains one of the safest in the world, with hardly any incidents compared to other industries.

Publisher: Marcelo Frette

Access our downloadable: Open Banking Statistics | N5now