Following the investment round, the company announces its new shareholders

N5 Now, creator of software for the financial industry, finalized its first round of market capture and attracted eyes from large investors, the values of the transaction were not disclosed. With a demand received eight times greater than the investment amount sought, the company now incorporates new strategic allies in order to continue its development and meet the high demand in places that do not yet have operations.

The investors who participated in the round are: Illuminate Financial, as well as some of the world’s largest financial institutions such as J.P. Morgan, Citi, Barclays, BNY Mellon, S&P Global and Jefferies; – Exor Ventures, the venture investment arm of Exor N.V.

Check here the Media Kit of Startupi!

For Julian Colombo, CEO of N5 Now, this movement was driven by the desire to bring in high-level strategic partners, bringing in the market expertise of companies like these. “We have seen an exponential increase in demand, exceeding our most optimistic forecasts. That’s why we understood that it was time to partner with great partners with the expertise that will allow us to serve these customers faster and keep up with our global growth,” he says.

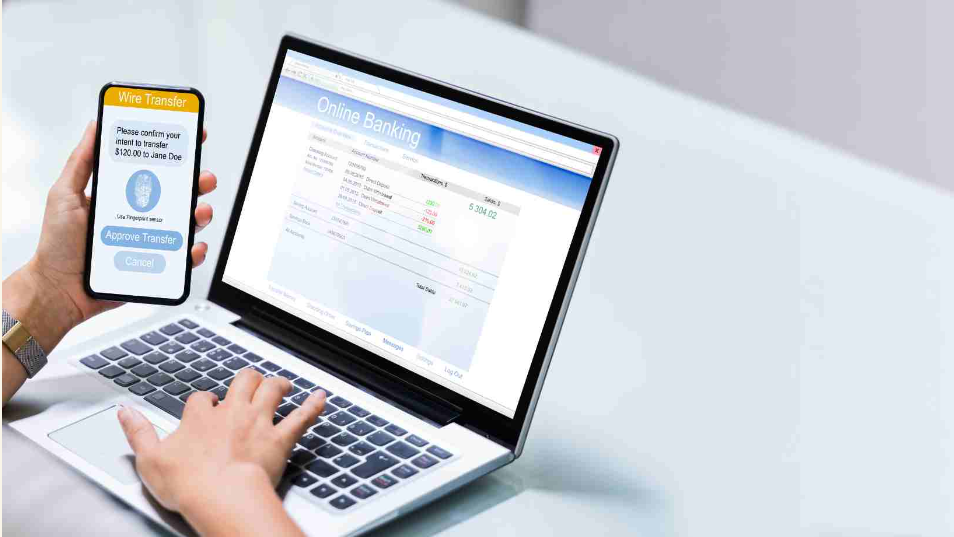

N5 Now offers security and quality software for banks

Founded by executives who came from banks, N5 Now was born with the intention of transforming the sector, helping financial institutions to deliver greater efficiency to their customers and prepare for the new demands of the industry. In its portfolio of clients of the platform and services are companies such as: Mastercard, Santander, among others.

Among the products and services offered, the N5 Now platform is its flagship, a systematics platform with native integration of all the necessary software of a financial institution, such as CRMs, BPMs, incentives and Omnichannel, being able to break down the natural barrier of a bank to innovate, since it frees these institutions from the complexity of their legacy systems.