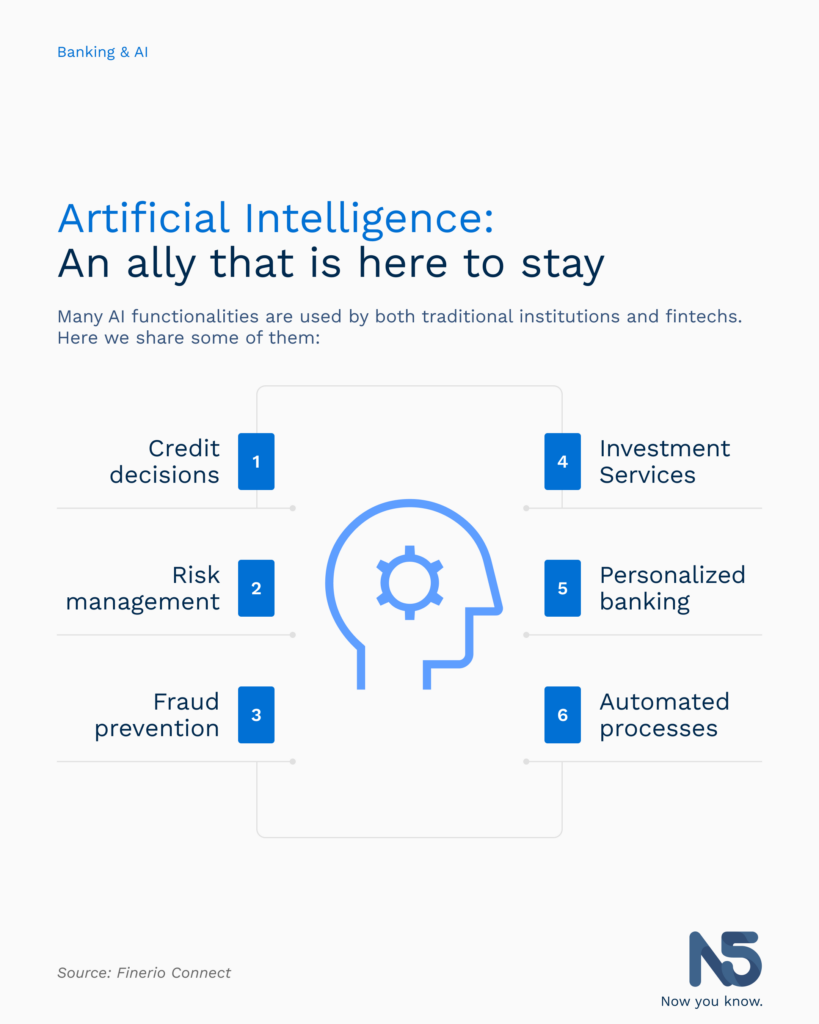

Artificial intelligence is changing the way we live, and it is now possible to see various uses of artificial intelligence in financial services. Here we share some of the most popular.

- AI and credit decisions

AI offers a faster and more accurate evaluation of potential customers, at a lower cost. This allows you to make more informed decisions. An alternative credit score that uses AI is much more comprehensive and sophisticated compared to traditional credit scoring criteria. This helps lenders distinguish between high-risk customers and those who are not risky but do not have a credit history. Digital and fintech banks use automatic learning algorithms, also known as machine learning. With alternative information, for example from different bank accounts, you can better evaluate potential credit customers and provide personalized options. - AI and risk management

The processing power allows you to handle large amounts of data in a short time to manage structured and unstructured data, a task that would take too much time for a human. Algorithms analyze transaction histories and identify early signs of future problems.

It is possible to make predictions and generate details based on multiple variables, essential for financial planning, analyzing the activities of any market or environment in real time. - AI and fraud prevention

For several years, AI has performed well in detecting financial fraud, especially in preventing credit card fraud, and they are improving the algorithms with machine learning. With the increase in electronic commerce and online transactions, fraud has grown exponentially. Fraud detection systems analyze customer behavior, location, purchasing habits and establish security mechanisms when something seems out of the ordinary and contradicts spending patterns. - AI in investment financial services

The use of AI tools offers multiple benefits in investing through the stock markets. Intelligent investment systems monitor structured information (databases, for example) and unstructured information (from social networks, news, among others). All in a matter of seconds. And this exchange of values means faster decisions and transactions.

Predictions in the stock market are more accurate, since the algorithms are tested with past information and also put together recommendations for portfolios depending on the specific investor and their long-term goals. - AI and personalized banking

In the banking sector, AI provides immediate solutions such as mobile banking applications for customers with reminders to pay bills, plan their expenses and interact with their bank in an easier and more agile way, from obtaining information to completing transactions.

Various apps offer personalized financial advice and help people achieve their financial goals by assessing income, essential recurring expenses and spending habits; developing an optimized plan to meet goals. - AI and process automation

Forward-thinking industry leaders look to process automation when they want to reduce operating costs and increase productivity.

For example, intelligent character recognition makes it possible to automate a variety of mundane and time-consuming tasks that used to take thousands of man hours and inflate payrolls.

Using automation for high-frequency repetitive tasks reduces human error and allows a financial institution to refocus workforce efforts on processes that require human input.