Since the start of the pandemic, the sector has grown by 20%, and in total there are already 330 firms that provide digital financial services. They are in the sights of the State and have the support of users.

April 05 2022 13.00

In Argentina alone there are already 330 companies within the fintech industry, which places it as the third country in the region in importance, behind Brazil and Mexico. And although only 10% of them were created in 2021 (20%, if compared to the start of the pandemic), the evolution of the sector is evidenced by the fact that in the last year the number of members of the Chamber doubled Fintech Argentina, which already brings together 210 firms.

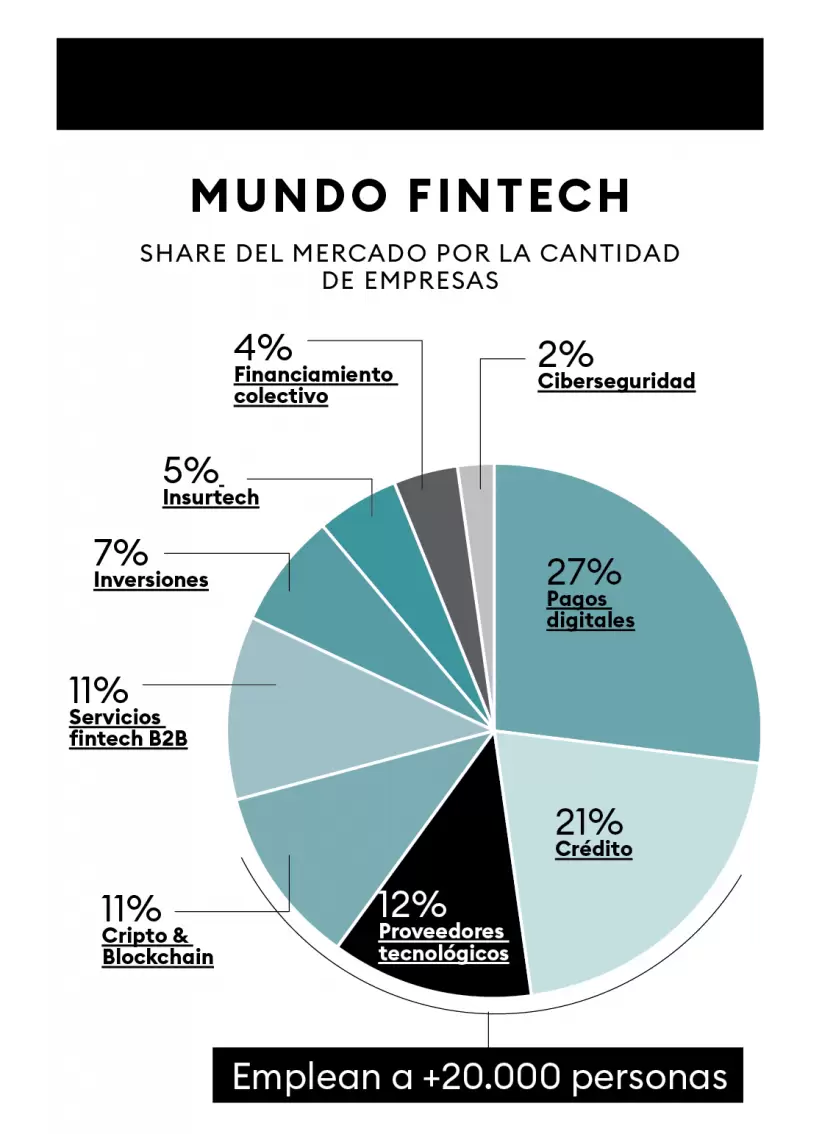

This industry has numerous verticals, with digital payments being the one with the greatest presence in the market (and the one that the vast majority of users use as virtual wallets). “This sector had phenomenal growth in the last two years. Today in Argentina there are approximately 30 million CVUs (virtual accounts), a number that has multiplied by 10 since 2020,” says Mariano Biocca, executive director of the Argentine Chamber of Fintech .

“According to the latest BCRA Financial Inclusion Report, one of the verticals that grew the most was electronic payments, reaching 8.5 operations per adult in the first six months of 2021 and being the highest historical value. POS and mPOS payments followed by QR code payments,” reports Leo Rubinstein, CEO of ank.

To this, Santiago Sánchez, Chief Product Officer at Naranja X, adds that digitization, the rise of ecommerce and the greater use of mobile devices contributed enormously to the growth of this vertical within the fintech ecosystem: “In our case, 54% of customers pay their credit card statement through digital means. Pre-pandemic, that indicator was 20%”.

“It is interesting to note that during 2021 the download of finance apps grew 122% compared to 2020, almost triple the speed of the global average. If this rate continues, in two years there will be more downloads from fintechs than from banks,” he highlights Alex Waltuch, Commercial Director for the Finance Industry at Google Argentina. To this he adds: “56% of Argentines choose digital channels as the main way to operate their personal finances, and one in three bank users prefer applications as their main service channel”.

In turn, in a country like Argentina, where credit is normally scarce, “a significant rebound was experienced throughout 2021, post-2020 lockdown. And crypto comes with extremely accelerated growth in terms of adoption. Currently, Argentina owns world-class companies that are competing side by side with global giants for the conquest of Latin America”, enthuses Biocca.

For Alejandro Melhem, vice president of Mercado Pago for Hispanic South America, digital financial services were essential to sustain economic activity during the pandemic. He explains: “They grew exponentially and are already part of the daily life of millions of people and businesses in Argentina and the region. Even so, we are convinced that there is still a lot to do to promote the development of this sector in our country. “.

For his part, Rubinstein assures that Latin America is one of the regions with the best prospects for the development of the industry due to the high level of access to devices with an Internet connection and the fact that a large part of the population is underbanked: “These two variables and an unsatisfied demand for financial services led to the emergence of a very significant number of new fintechs”.

“As a result of sustained growth, the fintech industry is one of the most heterogeneous in the country, because it has been incorporating a large number of new players, including startups, digital projects from traditional financial institutions and digital wallets from centralized finance, and P2P platforms and exchanges by decentralized finance or blockchain”, describes Andrés Ondarra, Country Manager of Bitso Argentina.

As for the world of cryptocurrencies, according to Marcelo Cavazzoli, CEO of Lemon, there are many factors that indicate that it is still a bull market: “Solid projects that propose to solve problems of the traditional ecosystem and have strong communities may be the ones that most benefit and get a price hike. Some examples of these projects are finance, gaming, NFT, entertainment, transactionality, and interoperability, among others.”

“For the next few years, the lines of the verticals are going to start to blur. Embedded finance is changing the market by generating a movement that will see companies offer more and more services to their clients, and that includes financiers. With what is going to happen is that a supermarket is also going to become a fintech that can give you credit, insurance, offer payments and financing. Today we can already see this in Brazil with Carrefour Pay”, explains Julián Lisenberg, co-founder and CRO of Geopayments. For this expert, transforming the user experience when it comes to how to manage their economy “is making companies and institutions have to think outside their comfort zone to face new demands”.

Investment round

The last year was one of great collection in terms of investment rounds for the fintech market. “Globally, in 2021, $1 in $5 of venture capital went to fintech startups and the sector received $131 billion in funding,” said Marc Winitz, Chief Marketing Officer (CMO) at Rapyd.

This trend also occurred in Latin America, and Argentina was not left out. “According to data from the Association for Private Capital Investment in Latin America (Lavca), startups in general, and not just fintech, have attracted US$15.3 billion last year, more than three times compared to the previous year. previous record, which was US$4.9 billion in 2019, once again showing that the ecosystem in Latin America is on the upswing”, they point out from Pomelo.

Ualá is a case that last August closed a US$350 million Series D round, led by SoftBank Latin America Fund and Tencent. “This allowed us to develop new products and attract talent for Argentina, Mexico and now also Colombia, which we have just launched. We have already issued more than 4 million cards in the region,” says Mariana Franza, Chief Operating Officer of Ualá. The executive highlights that it was also a good year for Ualá Bis, the collection solution for companies: “Between January and December 2021, the monthly transaction volume grew 47 times, the number of active merchants was 8 times greater, and each time they add more resellers throughout the country”. Ualá also signed an agreement to acquire Wilobank (it is still subject to BCRA approval), showing the way for many companies in this sector that seek to grow and regionalize. Another example is that of Buenbit.

“During 2021 we went from 250,000 users to more than 600,000, the team multiplied by 3, we raised a series A investment round for more than US$11 million, we landed in Peru and Mexico, and we laid the foundations to be one of the players in Latin America. We expect to have a similar growth by 2022. We have the ambitious goal of reaching 2 million users at the regional level, we want to double the team that has already exceeded 250 people, and we plan to open operations in Brazil, Colombia and Chile “, they list from the company, the first crypto fintech in Argentina to launch a Mastercard prepaid card, with no issuance or maintenance cost, which is international and which repays 2% in crypto for each consumption. “In addition, we launched an investment product that allows users to invest in decentralized finance (DeFi) protocols through our platform in an extremely simple way, we list new cryptos, we make strategic alliances with important players in the real estate and automotive sectors, among others. many other things”, reflect from Buenbit.

“There is much to be done in terms of technological infrastructure to help accelerate the launch of quality financial services for the end user. Today, financial services in the region run on top of obsolete technology, fragmented by country, which was created with financial services in mind. traditional services offered by banks and not in the current state and volume of digital services in the region”, they say from Pomelo. In this context, Julián Colombo, CEO of N5 Now, warns that, although digital financial services companies are raising a large number of investments, they are not yet making a profit. What do they have in favor for them to invest in them? “The potential for the future, the value of data and how they play when it comes to distributing information to users. On the opposite side, traditional banking continues to make profits and they did not lose market in this regard,” he differentiates.

Transparency and clear rules

When addressing the issue of regulations in the sector, opinions are divided, although everyone agrees that the presence of standards allows for a market with clear rules, which is what everyone is fighting for: transparency. Hernán Piñeiro, CEO of Worldsys, maintains that these companies “have adapted to comply with money laundering laws by properly identifying their clients and the risks, as well as analyzing their operations. It is a very proactive sector and we have had clients who they have incorporated anti-money laundering software even when the regulations did not require it. We see the sector very active in complying with these issues”.

“Like any other company, we are in constant contact with the regulators of all the countries in which we operate. One of the latest great examples is the implementation of the Transfer 3.0 regulation, which required the articulation of the work and effort of all the players in the industry,” says Melhem. However, at the same time, he points out that he is concerned about regulations such as the one at the end of December (when virtual wallets were forced to have the funds of the means of payment 100% deposited), “which hinder the growth of the sector and discourage the financial inclusion of thousands of people”.

“Profitability should not be a consequence of one or another regulation of the regulator, but of the acceptance by users of the value proposition of companies. We understand that the BCRA is willing to build an increasingly transparent and competitive fintech ecosystem , and we hope that the regulations encourage the digitization of financial services, with clear rules that give certainty to all the actors in the system,” says Sánchez.

“For example, in Mexico (where we have been operating since April 2021), the Fintech Law has been in force since 2018, which establishes regulations, limits, work groups, as well as reports, future planning. This shows the great difference that exists in compared to other countries that are still far from having clear and precise guidelines for the sector. This type of law promotes the growth and order of the sector, as well as a clear framework on which to base itself to operate correctly and harmoniously”, they observe from AlPrestamo .

If something needs regulation, it is digital currencies, because it is so new that it requires clear rules to generate trust in the market. “In Argentina there are two bills to deal with the issue. From Lemon we work together with the Argentine Chamber of Fintech so that the regulation can contemplate the needs of users and be favorable for crypto adoption in the country. Sometimes it is understands regulation as a bad thing, but it is not necessarily so. Establishing clear rules is important to reduce uncertainty and that more people can have their cryptocurrencies, “says Cavazzoli.

s in the digital sector by the State must go behind the advances in job creation and in the improvement of the traceability of transactions that allows a much faster circulation of money. Following the quantity theory of money, the increase in speed would allow a greater growth of the economy. And not only that, the ability of the economic authorities to be able to obtain data at the macro level would allow them to anticipate the cycles for the correct decision-making of economic policy in the event of a fall in the product or even in a fall in employment levels. “, says the economist Mariano De Rosa.

Fernando Quiroga Lafargue, Financial Services partner in charge of the Fintech Industry at KPMG Argentina, does not perceive public sector officials fearing the development of this industry: “I do believe that, beyond some initiatives, there are still several pending thresholds in terms of of financial inclusion and reversing economic informality through the use of cash payments. In this sense, it should be a State policy where several fronts are attacked at the same time, including tax aspects and the provincial level. Fintech are natural allies of the State in this dynamic”.

Inclusion, the ultimate goal

In a market like Argentina, where underbanking (people have a savings account, but do not access bank loans) remains high (close to 70%), fintechs find fertile ground to grow. “In this line, for example, we developed together with Red Link for Banco Provincia the DNI Account application, a digital solution that has more than 4 million users who can carry out multiple operations from the comfort of their cell phone”, explains Marcelo González, CEO and co-founder of Veritran, a firm that also relies on low-code to further expand inclusion. “In turn, we worked together with Banco Nación and Red Link in the development of BNA+, a digital wallet whose main objective is to promote financial inclusion by facilitating access to banking services for all sectors of the population in Argentina. It represented an opportunity for the thousands of beneficiaries of social programs and retirees, allowing them to access a simple and agile digital solution to carry out their usual banking procedures”, explains González. Currently, regulations in Argentina are geared towards payment service providers (PSPs) and crowdfunding companies. “With the exception of Mexico, which has the aforementioned Fintech Law, no country in Latin America has regulations, but rather have more specific regulations issued by regulatory entities such as the CNV and the BCRA,” they clarify from Open Pass. And they add: “With the great growth of new companies, it makes sense that there are new regulations. However, it is important that this is not a limitation and is consistent with the ecosystem, so that it does not eliminate the dynamism that characterizes it.”

Open banking

Regarding open banking –another of the topics that dominates the fintech agenda–, according to Rubinstein, from ank, at a regional level, Argentina is a few steps behind Brazil or Mexico, although it has evolved a lot in recent years: “There is no official regulation, but little by little the first steps are being taken. One example was the launch of Transfers 3.0 in November, which made Argentina the first country with a fully open digital payment system.”

“From the arrival of interoperability, we expect the growth of transfer payments. In Brazil, more than 70% of retail payments are with PIX, and Argentina should go down that path. In addition, the crypto sector will surely continue to show great growth and new products throughout the year,” says Rafael Soto, CEO of MODO. And he adds: “With MODO, the banks anticipated the arrival of open banking. What they are doing today in Argentina in other countries was based on regulations. Here the banks made the decision together to promote this project, and this speaks volumes good of the local financial system. To the extent that the BCRA promotes open banking initiatives, the system will be much more prepared to be able to implement them in a much more agile way because a large part of the work will already have been completed”.

But there are still many challenges to overcome, and the shortage of talent is one of the most urgent. “The sector is expected to generate around 20,000 direct jobs. And by the end of 2022 it is projected to grow by 50%. Companies face difficulties in finding talent, and that is why we constantly innovate to attract and retain collaborators. In addition to the salary proposal, we have a comprehensive value proposition of benefits, flexible work, recognition, continuous training and more,” says Carretino.

Lastly, the issue of data portability is becoming more and more popular among companies and it is already a sustained demand. “This would allow users to more freely manage their personal data provided to online service providers, being able to move or transmit it more easily and transparently from one computing environment to another. In the crypto world this is already happening, because – thank you to the technology that supports them – it is possible to provide users with access to their funds (and very soon to their identity in the digital world) from any device anywhere in the world”, says Juan José Mendez, Chief Brand Officer of gravel.