China: The Fintech Giant

Did you know that the fintech market in China is huge? The country is one of the largest economies in the world, but historically it has not been a good place for banking. On the contrary: most of its population does not even use credit cards.

So why is China making such a big splash in the fintech market? What is the forecast for the future? Will the country become a cashless society? Find out in this edition of N5 Insights.

China Has the World’s Largest Fintech Market

The Chinese market is one of the largest and most influential in the world, and when it comes to fintechs it is not far behind. The country currently has an abysmal number of digital financial services companies operating — a very different situation than the United States.

But how big is China’s superiority in terms of fintechs? Well, just take a look at the graph below that compares the usage percentage of the top 4 services offered by financial tech companies: online payments, financial management, financing, and insurance.

As you can see, China far outperforms the other countries in all four categories.

In addition to this, China currently has up to 18 unicorn fintechs — that is, valued at more than a billion dollars.

Among these companies is Alipay, which is simply the largest fintech in the world and is valued at two hundred billion dollars.

China’s Bank Rigidity Accelerated Fintech Growth

As we can see happening in South America, in China, banking rigidity opened the playing field for the growth of fintech. This is a country where credit cards are rarely used — everything is handled in cash.

Historically, much of the Chinese population has been marginalized when it comes to accessing banking services. Without going any further, between 2012 and 2014 only 10% of Chinese could access credit in the financial sector. In the case of SMEs, this percentage was close to 25%.

This unbanked public is what Chinese fintechs have targeted. In the last few years alone, the mobile payment sector has grown enormously in the country, reaching 16% of the national GDP. Compare that with the case of other countries such as the United States, where this sector barely represents 1% of GDP.

Let’s take a look at the growth of the two largest Chinese digital financial companies: Alipay and WeChat Pay.

As the chart shows, in recent years these companies have enjoyed tremendous growth, growing from a few hundred million to billions of users.

Currently 92% of the Chinese population uses Alipay or WeChat Pay as their main payment method.

China is Becoming a Cashless Society

The mobile payment sector has seen tremendous growth in China, with cash becoming increasingly less important. This is why the country is on its way to becoming the first cashless power.

The graph below just shows how the use of cash has fallen in various countries.

The mobile payment sector has seen tremendous growth in China, with cash becoming increasingly less important. This is why the country is on its way to becoming the first cashless power.

The graph below just shows how the use of cash has fallen in various countries.

Made in China, for China

The fintech sector in China has a series of peculiarities that make it a unique environment to which the country has been able to adapt.

First of all, China had a particular situation regarding credit cards. As we already mentioned, these were reserved for only a small percentage of the population. Even brands like Visa or MasterCard were restricted in the country until recently. Thanks to this, Chinese digital finance companies do not have large competitors and it is easier for them to penetrate the market.

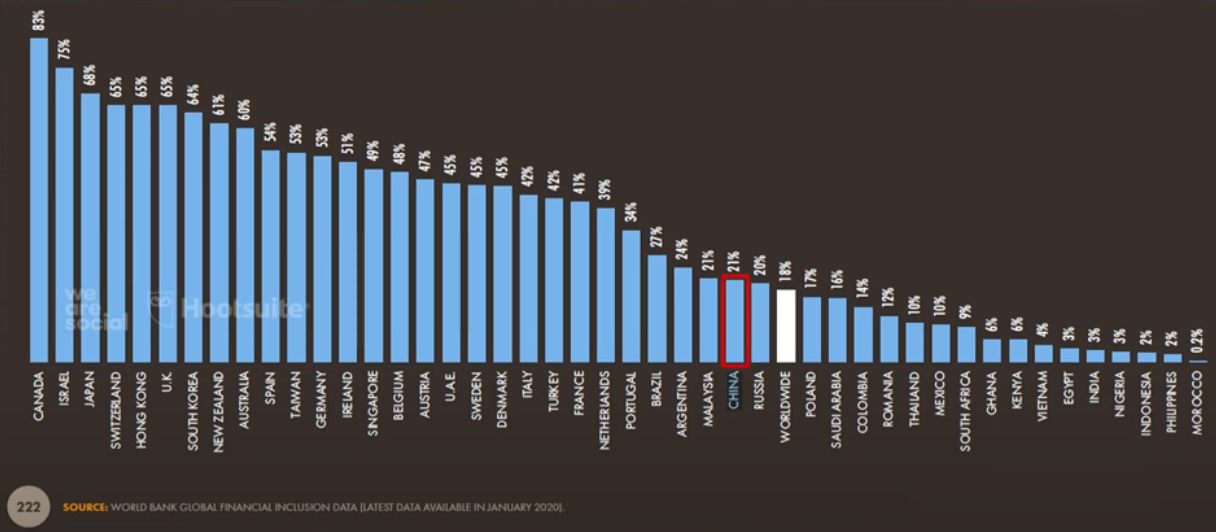

In the following graph that shows the penetration rate of credit cards in different countries, we can see just how low China is on the scale.

In addition to this, fintech companies are comprehensive. This means that they offer both payments and credits, electronic commerce, insurance and even financial management. This allows them to control the entire financial sector.

As if that were not enough, the Chinese market is a local one, where the vast majority of companies do not have international expansion plans. In addition, the Chinese government has been in charge of keeping these companies happy from the beginning, offering them low regulation and even financial aid.

Regulations Increase

Recently, the Chinese government has been gradually leaving behind the permissive behavior it had towards fintech, replacing it with more regulations that could slow down the growth of these companies.

These regulations are due to a series of risks that the government has identified.

The first of these risks is cybersecurity, which is resolved with more efficient measures to protect people — after all, 90% of banking transactions are done online. This also goes hand in hand with the risk of handling user data, which until now was highly unregulated.

In addition to this, the government wants to establish that fintech companies finance at least 30% of the loans they collect.

Finally, there is the fear of monopolies, which has led the Chinese government to take measures to avoid a situation of unequal competition. For example, they stopped Alipay’s IPO.

Conclusions

As we have seen, fintechs in China have enjoyed unlimited growth, which has allowed them to corner the payments market and move the country towards a cashless future. These are the main points to remember:

China has the largest fintech market in the world, far above the rest of the countries.

Banking rigidity and the impossibility of the Chinese people to be banked opened the field of fire for digital finance companies.

China has 56% lower cash usage than it did just ten years ago. The future is cashless.

A series of factors such as low competition and government cooperation have created the perfect environment in China for accelerated growth of fintech.

Regulations are approaching that may end up slowing the growth of these companies.

Publisher: Marcelo Frette