These are 3 bots that would multiply customer service by 100. How much does it cost to implement them and what functions do they offer?

The multinational technology company specialized in the financial industry, N5, presented three tools aimed at streamlining dozens of banking processes and other financial organizations.

It is the first generation of AIs designed exclusively for this sector and aims to revolutionize the market. From the firm, they explained that the chosen system – “Fin Skys” or Financial Self-Contained Artificial Intelligence – involved an investment of 50 million dollars and the hiring of an exclusive team of Argentine engineers.

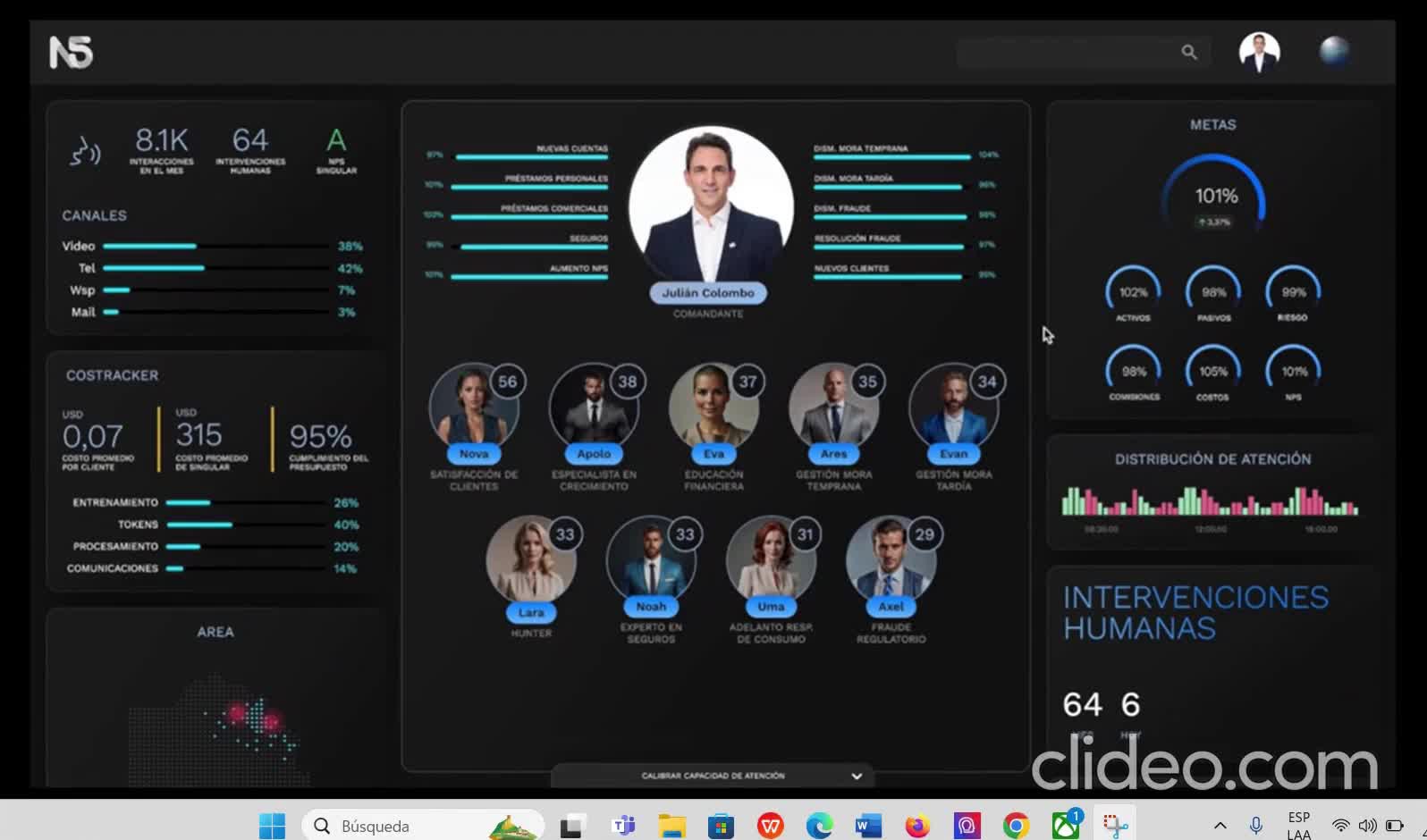

“Many noticed that the financial industry could have problems with AI, especially in computer security and other aspects,” warned N5 CEO Julián Colombo at the official presentation of this series of tools. He added: “The new tools will drive cost reduction by 94%, generate 9 times more productivity in teams, reduce risks by 25% and increase NPS (customer satisfaction) to 35 points. The company seeks to redefine the standards of operational efficiency in financial institutions and, above all, to positively impact the financial inclusion of Argentines.”

Artificial intelligence: N5 launched 3 bots to speed up procedures in banks

After clarifying that financial institutions must invest large amounts of money and that this type of technology would save resources, while continuing to provide personalized attention, Colombo listed the tools in question.

Julián Colombo is CEO of N5, a multinational technology company specializing in the financial industry.

Each bot or automation system offers various functions and is intended for a certain area or position in each financial institution.

ALFRED

It is a kind of ChatGPT, focused on the financial industry and which aims to provide facilities to the executive of any bank or company.

In his presentation, Colombo said: “Pretend that I am a bank manager or anyone with a role in the financial industry. That person must know the rules of conduct of their organization, rates, the services they offer, but with Alfred, an entity only has to feed them with information. Banks spend immense amounts of money on support desks or other resources to resolve queries or emails. This makes the task much easier. It seems that it can be a very expensive and complex system, but everything can be implemented in 24 hours and for our customers (who have more than 100 employees) it is at no cost.”

With this resource, those who have decision-making positions in financial institutions will be able to know which customers have unresolved complaints, who are on the payroll but did not contract products and hundreds of other things in seconds. The limit of a customer’s card could even be extended (automatically), although the last step must always be confirmed by a human being. It is a very fast and large-scale assistant.

Alfred is a kind of ChatGPT, focused on the financial industry.

PEP

“It has all the same information as Alfred, but it does much more,” clarified the CEO of N5 at the exhibition where iProfesional was present. And he added: “It’s like a boss or a coach (not only mine but all my colleagues) who gives generic advice, for a meeting or any aspect that has to do with productivity. You can suggest to me which client to offer credit to in order to be successful or you know who is the best collector in the company. He can even pretend to be a customer who has a backlog and helps practice anytime, anywhere. I can practice a conversation with Pep before I call my client. Pep pretends to be that customer, according to the information available.”

It is worth clarifying that this tool will be available regardless of the system (CRM or VPN) used by the interested company.

“Alfred and PEP are not from the organization, they belong to each of the people. They see the customers that only I see. Another colleague’s Alfred and PEP will be different and have different conversations. These AIs can only perform authorized procedures for each employee in question. If an employee is authorized to cancel a card, they will be able to move forward with that procedure, for example. Only 1% answer poorly, because it has a distributed logic,” Colombo warned about this second bot.

Post-Singularity Financial Executive

It is the “world’s first software for FinScai AI chiefs,” N5 highlighted.

“Someone who until yesterday was an executive in a branch with hundreds of customers, today can supervise an AI that does the same or better on a much larger scale. And much better, because it learned from the best 1% of collectors, or salespeople, or specialists in investments, growth, management of arrears, fraud, etc. Or a Hunter that can bring in 100 times more customers, because it copied the best and on an exponential scale. You can go from 300 customers to 30,000,” Colombo explained about this third resource.

In short, the Financial Executive represents 9 executives from different areas.

Colombo concluded: “Many tell us that for this we are going to need many fewer people. But in reality, companies that do not add this type of system are going to disappear. Today there are 1,400 million unbanked people and almost all of them would like to be treated, but the cost of care is greater than the benefit. The financial executive would allow someone to be served for a few cents to include them financially in the world.”

As for the cost, the company pointed out that any company that brings together more than 100 employees will be able to implement this system at no cost. Otherwise, the investment starts at $300 per month.