Artificial intelligence (AI) is consolidating itself as a strategic tool for banking and insurance in Latin America.

The region is experiencing a boom in adoption, investment, and the development of solutions that are transforming the way financial institutions and insurtechs generate efficiency, reduce costs, and enhance the customer experience.

Banking and the digital transformation

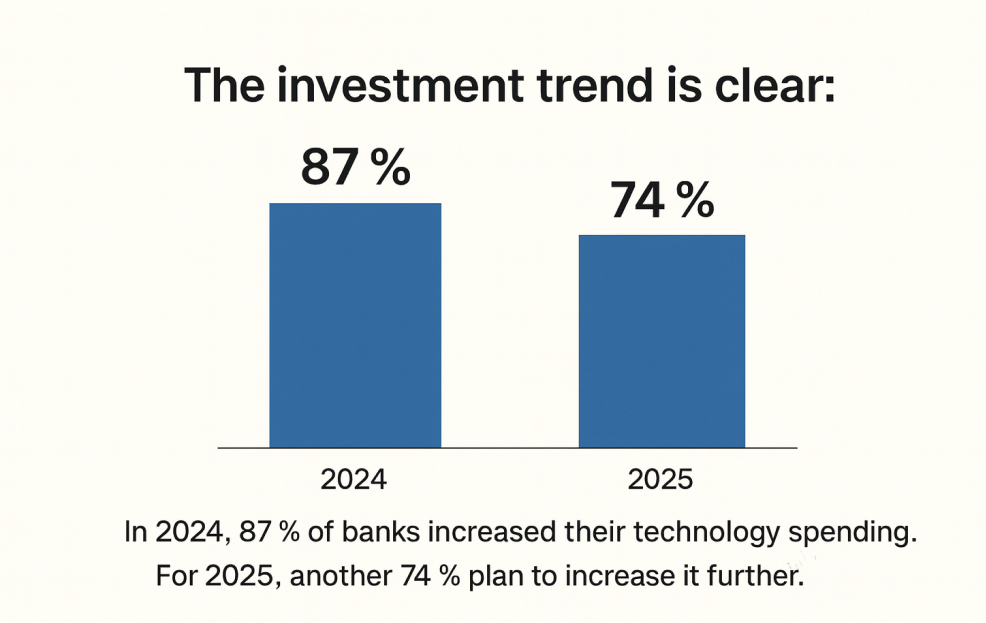

A study by Infocorp indicates that 8 out of 10 banking leaders in the region consider AI and machine learning as key to efficiency and personalization. However, only 35% of institutions have implemented them effectively.

Insurance and insurtech: accelerating change

The insurtech ecosystem in Latin America is showing remarkable expansion:

- There are more than 500 active startups, with organic growth of 11%.

- Investment reached US$ 121 million in the first half of 2025, a 370% increase compared to 2024.

- In addition, the insurance market grew 17.1% in 2023, reaching US$ 203.354 billion in premiums.

However, the insurance protection gap (IPG) remains high, estimated at US$ 301.3 billion, representing a major opportunity for innovation.

N5’s value proposition

N5 positions itself as a benchmark in the implementation of customized AI solutions for banking and insurance. Its focus is centered on:

- Intelligent virtual assistants such as Aifred, specialized in financial documentation, and Pep, a digital coach for executives.

- Predictive models for risk and fraud based on generative AI.

- Automation of key processes: claims assessment, premium evaluation, and customer service.

- Strategic consulting for technological modernization and AI roadmaps.

With a team of experts and regional experience, N5 helps bridge the gap between perception and real adoption of AI in the financial sector.