Silicon Valley Bank (SVB), the bank that financed startups at the heart of America’s tech, filed for bankruptcy due to liquidity problems, becoming the biggest failed US lender in more than a decade. With more than $200 billion in assets, SVB had quadrupled in size in the last five years and was valued at more than $40 billion last year. However, trouble for the bank began when it announced a significant loss on its portfolio and then tried to raise more than $2 billion to balance its finances.

California state regulators stepped in Friday and took possession of the lender, naming the receiver of the Federal Deposit Insurance Corporation (FDIC for its acronym in English). The move highlights the impact that rapidly rising US interest rates are having on smaller banks. SVB is the second regional lender to shut down this week, after Silvergate Capital announced it would voluntarily liquidate its bank, sparking a sell-off in bank shares.

Why did it collapse?

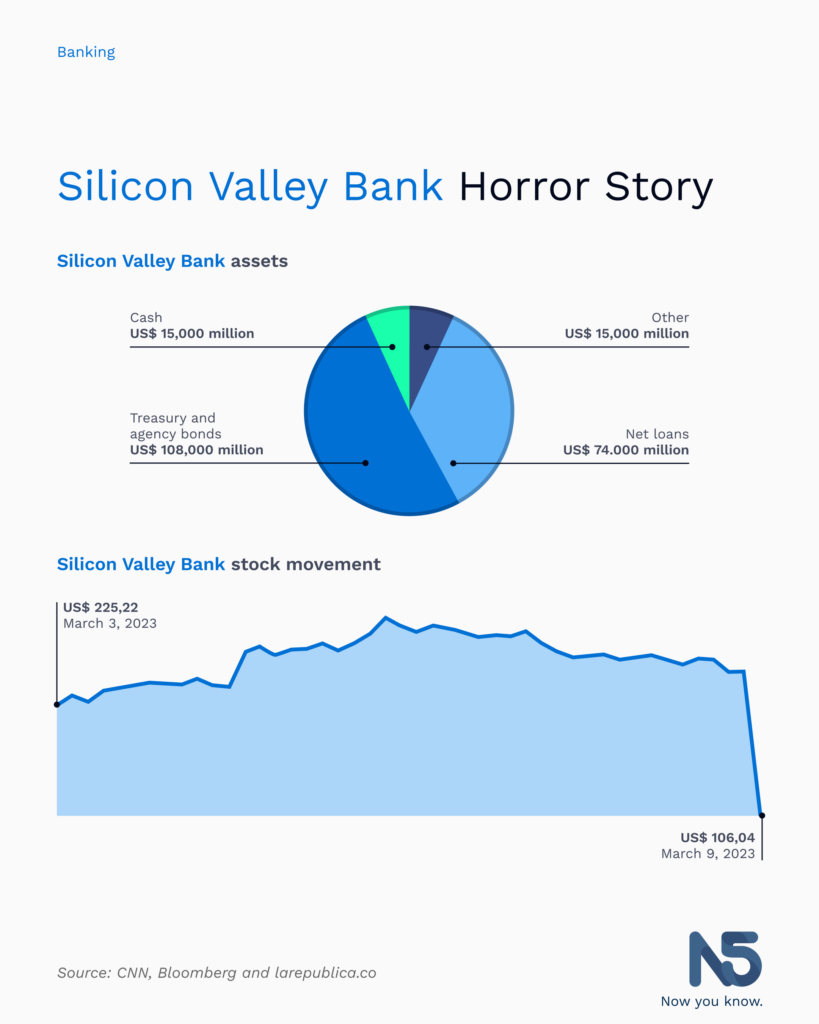

The collapse of the SVB bank was sudden, after customers withdrew their deposits in a bank run. However, the root cause of the problem dates back to years before, when the bank invested billions in US Treasuries with near-zero rates. When the Federal Reserve aggressively raised interest rates to control inflation, the value of the SVB’s bond portfolio eroded. In addition, the rate hike pushed up borrowing costs, forcing tech companies to turn to bank deposits to finance their operations and growth.

The bank run was triggered when the bank announced it would sell shares to fix its finances, causing panic among customers who withdrew their money. The bank’s shares fell 60%, dragging down other bank stocks and raising fears of a financial crisis. Ultimately, regulators closed the bank and placed it under receivership to liquidate its assets and pay depositors and creditors.

Although the FDIC receivership will end the uncertainty about this particular bank, experts warn that customers and depositors may feel less secure if they have any asset exposure or hold their own money at banks with similar risk profiles. In any case, the SVB bankruptcy shows that rising interest rates can have a significant impact on the financial stability of banks, even the largest and most successful ones.