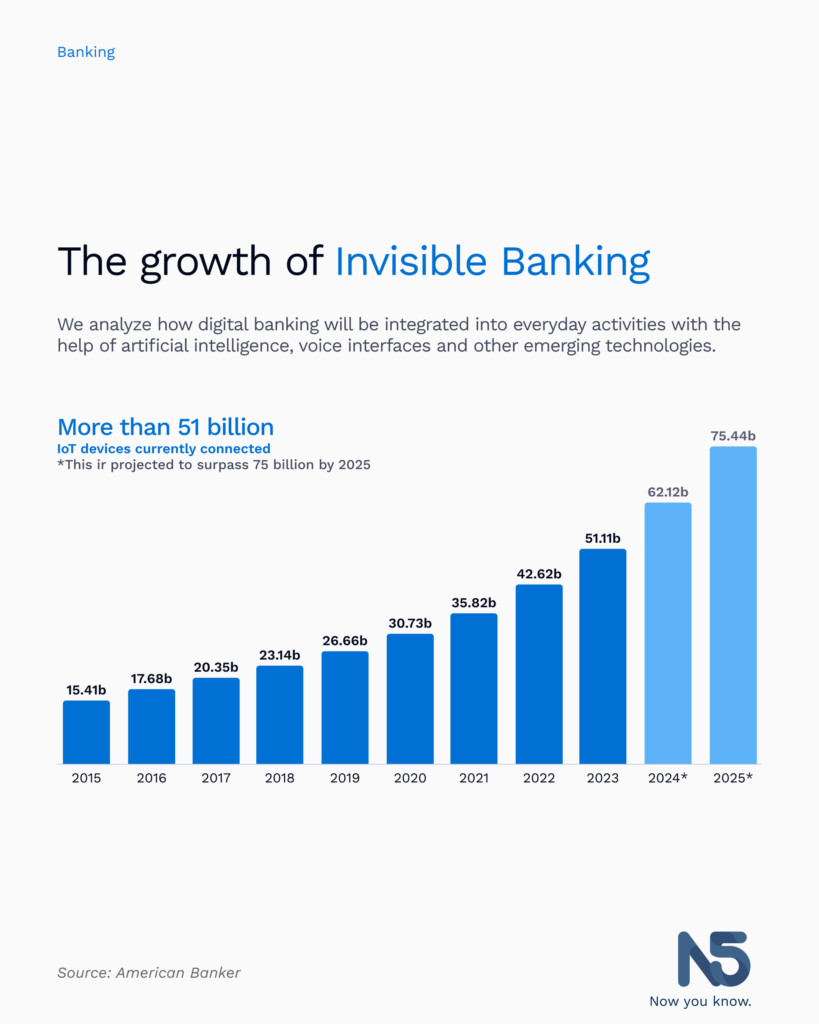

Invisible banking is becoming a reality thanks to the advancement of digital banking technologies and the integration of financial services into our daily lives. Internet of Things (IoT) technology plays an important role in this change, as wearable devices can connect to bank accounts and allow transactions to proceed seamlessly. In addition, voice banking is also gaining ground, which will allow users to make transactions simply by speaking to their devices.

Another key aspect of shadow banking is financial wellness, as banks and financial apps offer tools and advice to help customers manage their finances more effectively. Financial wellness apps can help users understand their spending patterns and offer tips for saving more and avoiding unnecessary spending.

In the future, shadow banking is expected to become even more automated and personalized, with banking services integrated into all aspects of daily life. For example, a connected car could automatically make a parking payment when leaving the parking lot, or a smart fridge could automatically order and pay for groceries.

While shadow banking offers many benefits in terms of convenience and efficiency, it also raises concerns about the security and privacy of customers’ financial data. Banks and technology companies must take appropriate measures to ensure that financial data is protected and that the privacy rights of users are respected.