Changes in Open Banking and Open Finance

Open Banking and Open Finance are changing the world of finance in a way that has never been seen before. The free use of user data opens the doors to a great number of possibilities.

What are the new trends within this technology? What other sectors and industries benefit from the free use of user data? What considerations must be taken into account related to user safety?

All this more in today’s edition of N5 Insights.

Technologies driving the move from ‘Mobile First’ to “Api First”

Currently, consumers do not want to continually switch platforms when purchasing a new product or service. Rather, they seek simplicity and speed, and give priority to entities that give them everything integrated.

Through Open Banking, the APIs are what allow this type of integration. For this reason, although before the priority was to design simple mobile applications, now the focus is on APIs, which allow different products to be integrated into applications.

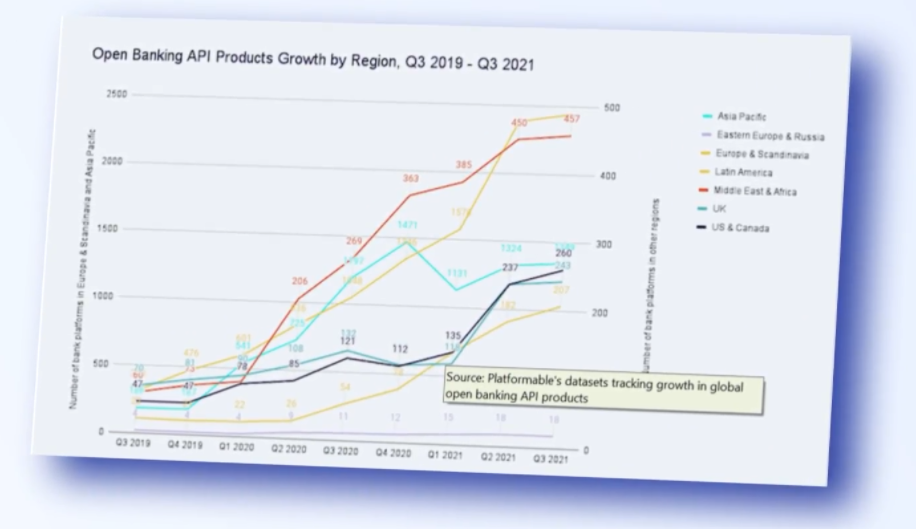

The following graph shows precisely the progress of this trend focused on APIs in recent years:

This is why those entities that do not focus on the design and production of APIs will be left behind compared to the rest of the market.

Big push for UX improvements

With the arrival of Open Banking, customers are having access to a wide variety of products and services. Among them, those offered by Fintechs, which are characterized by a very good customer experience.

Because of this, the general level of customer experience has grown in the area of Open Banking. In fact, 91% of UK Open Banking users find the services friendly and easy to use.

Additionally, 76% of users are interested in continuing to use these services, and 84% are considering expanding their use.

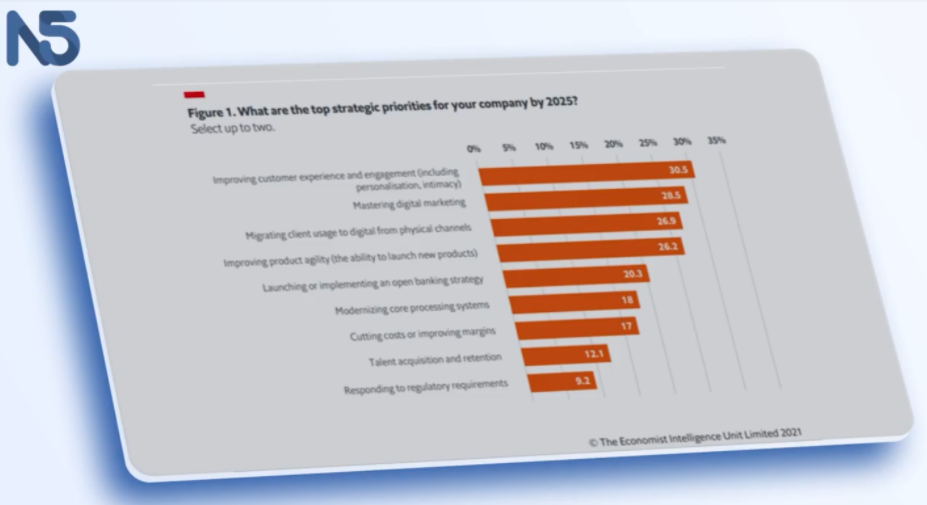

The chart below shows that 4 out of 5 bankers believe that financial institutions will seek to differentiate themselves on UX rather than the products themselves.

The customer experience has become a central issue for banks. This includes the security given to user data.

For example, a study carried out in Africa indicates that users are willing to pay more for a service that is transparent about what it does with their information.

Growing financial inclusion

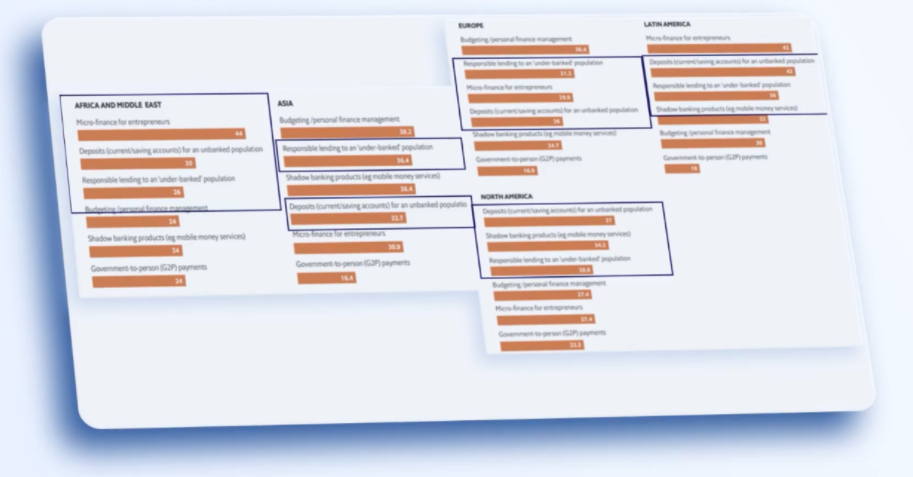

The contribution of Open Banking and Open Finance to financial inclusion occurs on multiple fronts. One of the most obvious is when it comes to product and service offerings. However, we can also see this contribution in the creation of financial profiles that allow the unbanked to access products that were previously denied them.

On the other hand, these also allow users to improve their financial knowledge. Without going any further, in the United Kingdom, 76% of users consider that their services have helped them save more, while 62% were able to reduce unnecessary expenses.

In addition to this, Open Banking targets small and medium-sized companies, providing specific services for them. The following graph shows precisely this trend of providing services to SMEs:

They help to promote specific segments inside and outside of finance

Until now, the services most benefited by Open Banking are those related to credit. This is due to the benefits that these bring to users.

Thanks to new financial data technologies, other areas and services are also benefiting. An example is that of the tourism industry, which can access customer information and provide better service.

In addition to this, digital identity providers can take advantage of open APIs to access customer information and streamline processes.

Another beneficiary is the insurance industry, which can provide more personalized service and better manage things like reimbursements.

In the case of the real estate sector, these technologies allow access to tenant information and allow them to decide who will be the best client.

Even when it comes to governments, they benefit from being able to collect data on how their citizens are doing in different areas. This can allow the creation of better public policies.

Improper handling of data can cause problems

One of the greatest benefits of Open Banking and Open Finance is that they allow easy access to vital information. However, this comes with a risk: the information an entity has about a person may be biased.

If a person has been miscategorized within an organization, for example, this misinformation will now be replicated across different industries and businesses.

This involves the risk that this person is further harmed. That is why the veracity of the data must be a priority for the future.

Conclusions

Open Banking and Open Finance are bringing great changes in the world when it comes to sharing people’s data. These changes are mostly positive, but you still have to be aware of the possible risks.

Here are the main points to keep in mind:

- The industry is making the move towards “API First”, which means that it is increasingly capable of providing a more complete service to its users.

- In recent years, the User Experience has become a fundamental factor for banks and Fintechs around the world

- Financial inclusion remains one of the main drivers of these new data technologies

- Not only the finance sector is benefited. Tourism, real estate, and the insurance industry are just some of the areas that can provide better service thanks to these technologies.

- It is necessary to take into account that the reliability of the data is one of the main priorities at the moment, since this is what will avoid problems in the future.

Ed: Marcelo Frette

Access our downloadable: Current State of Open Banking in the World | N5 | N5now