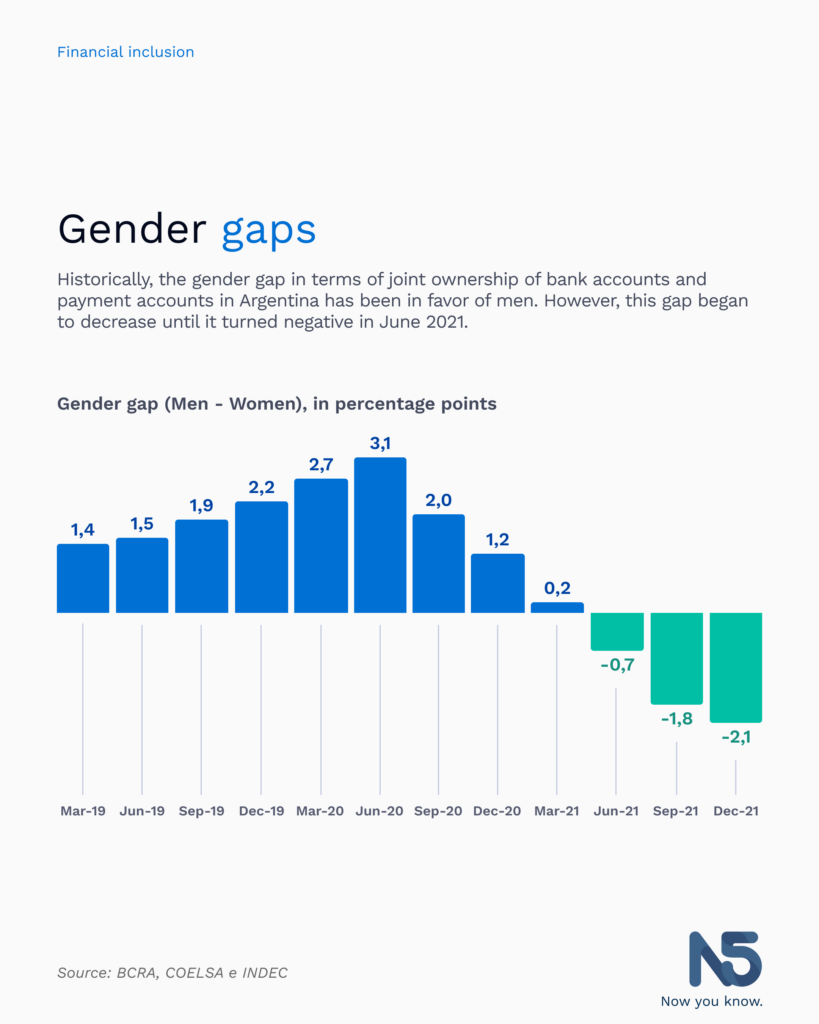

Throughout history, women in Argentina have had a significant presence in holding bank accounts due to their high degree of participation in social assistance, retirement and pension programs. However, in terms of ownership of payment accounts, the gender gap has favored men, which has also been reflected in the joint ownership of both types of accounts.

However, starting in June 2020, the gender gap in joint account ownership began to decrease and turned negative in June 2021. This change could be related to the evolution of the labor market, which has shown a decrease in the gaps in favor of men during the same period. In addition, the employment levels of women have reached maximum values since at least 2007. Consequently, almost half of adult women in Argentina had both types of accounts as of December 2021, which represents significant progress in terms of access to the formal financial system.

It is important to address this gender gap in banking access, since access to financial services is essential for financial inclusion and economic development. Measures to reduce the gap could include the promotion of financial education for women, the elimination of geographical barriers and the promotion of accessible financial services adapted to the needs of women.