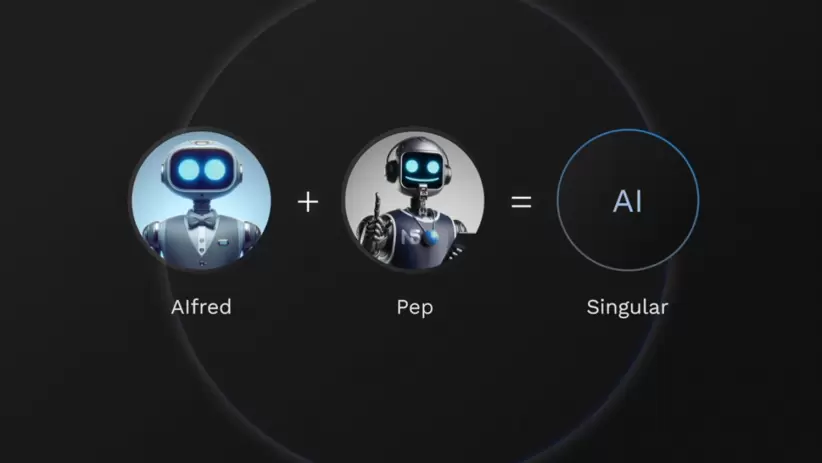

These innovations, called Alfred, Pep and Singular, promise to optimize and enhance financial and insurance operations, offering advanced and personalized solutions for their users.

04 July 2024 14.24

N5, a systemic platform for banks, insurance companies and fintechs that was included in the Forbes Promises list, announced the launch of its Fin Skys (Financial Self-Contained Artificial Intelligence), three Artificial Intelligence (AI) tools designed for the financial industry. This was announced this noon through a virtual presentation by Julián Colombo, CEO and founder of the firm that has a presence in 15 countries.

The investment for the development amounted to US$ 50 million and the tools, called Alfred, Pep and Singular, promise to optimize and enhance financial and insurance operations, offering advanced and personalized solutions for their users.

The use of these new tools could lead to a 94% reduction in costs, generate 9 times more productivity in teams, reduce risks by 25% and increase customer satisfaction by 35 points, N5 highlighted in a statement. The company, which a few months ago announced that it was looking for companies to acquire in Peru and thus expand in that country, wants to redefine the standards of operational efficiency in financial institutions and positively impact financial inclusion.

According to data from the company, some 1,400 million people around the world do not have a bank account, which prevents them from accessing payments, collections, savings and credit. According to Colombo, AI can drastically reduce customer service costs, allowing organizations to expand their customer base and improve retention through personalized attention.

The first of the new tools, Alfred, is introduced as the “bank butler”, giving a nod to Batman’s famous butler. Alfred is designed to be a sophisticated personal assistant that simplifies and streamlines administrative and management tasks for banking executives.

“Alfred is a solution that allows banks and insurance companies to optimize the time they spend processing and managing information,” explained Colombo. “Banks can feed it with the desired information, and in a matter of seconds, Alfred vectorizes and organizes this data, allowing executives to find quick and accurate answers.”

One of Alfred’s features is its ability to integrate with different systems and platforms regardless of language or country, and its implementation can be done in as little as 24 hours. In addition, it allows executives to search for and answer outstanding questions in their emails and WhatsApp messages, making it easier to manage internal and external communication. Another feature is its ability to help with the calendar and predict user needs, improving operational efficiency.

The second tool presented is Pep, a personal coach that helps users to be the best version of themselves. The name is inspired by Pep Guardiola. Like Alfred, Pep feeds on the same information, but his capabilities go beyond task management. Pep acts as a mentor who provides productivity tips and prepares users for important meetings, helping them improve their professional performance. “Pep is like a mentor boss who knows better,” Colombo said. “It can suggest which customers to target, identify a bank’s best collectors or the most effective insurance salespeople, and provide simulations to practice with prospective customers.”

Pep offers a “sparring mode” so users can practice and hone their skills, and a “simulation mode” that pretends to be the next prospective customer, allowing executives to prepare in the best possible way. This tool is designed to integrate with any CRM system, making it accessible to all organizations, even those that are not N5 customers.

The last of the tools is Singular, designed to take the ability of financial executives to a new level, allowing them to oversee multiple artificial intelligences that can perform tasks on a much larger scale. “Singular is equal to the best executive in a company, but with the capacity of 100,” Colombo said. “This tool allows executives to not only supervise, but also command artificial intelligences, exponentially increasing their operational capacity.”

In 2023, N5 had a turnover of US$ 20 million and closed an investment round with which it attracted partners such as Illuminate Financial, which counts among its LPs firms such as Citibank, JP Morgan or S&P Global, among others, including the family offices of the best entrepreneurs in the region.

N5 projects 300% growth by 2024 and last year alone saw a 275% increase in its number of customers. In this line, in the first weeks of 2024, it added more than six big names in the Latin American financial industry to its client portfolio.